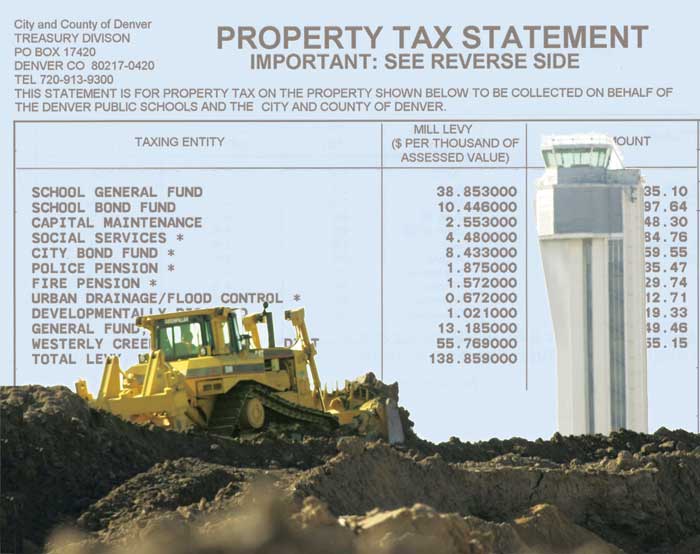

. . . and why they are higher than the rest of Denver.

From blighted land to a $6.9 billion development in 25 years and how Stapleton taxes pay for it

In 1995, after Stapleton airport closed, Denver faced the daunting task of redeveloping 4,700 acres that had a massive amount of concrete runways to be removed, huge structures to be torn down and an unknown amount of environmental remediation to be done.

Community leaders were actively pursuing a redevelopment plan with the social goals of sustainability and diversity in an urban neighborhood while developers saw obstacles that precluded anything but industrial uses. Some even said the land had a negative value.

Having just built DIA, the city and taxpayers were not about to approve bonds for redevelopment of the old Stapleton airport.

Where would the money come from? The answer was to use creative financing on a very large scale, both in dollars and in time. But when thousands of acres, billions of dollars, 25 years, state laws about taxes and special districts, and community input all get thrown together—the outcome is COMPLICATED.

Most people in Stapleton and NE Denver are vaguely aware of something called TIF (tax increment financing)—and they’ve heard that making purchases in Stapleton helps add money to the TIF and that might mean parks get built sooner.

And they know their taxes are higher than those on the west side of Quebec.

And that’s about it.

The Front Porch set out to make Stapleton financing understandable. If you turn the page and look at the outcome of our efforts, you may say we failed. But keep reading to get the big picture, and keep following the arrows on the next page. We think it will start to make sense.

Understanding TIF

Blighted land has conditions (like the need for major demolition and environmental remediation) that mean private developers would not improve it on the same timeline without some sort of public intervention.State statutes define what constitutes blight—and land that meets those criteria is eligible for tax increment financing (TIF).

If the conditions of blight are met, the geographic area eligible for TIF is defined and the TIF financing system is set up. Denver Urban Renewal Authority (DURA) is the entity that manages the Stapleton TIF.

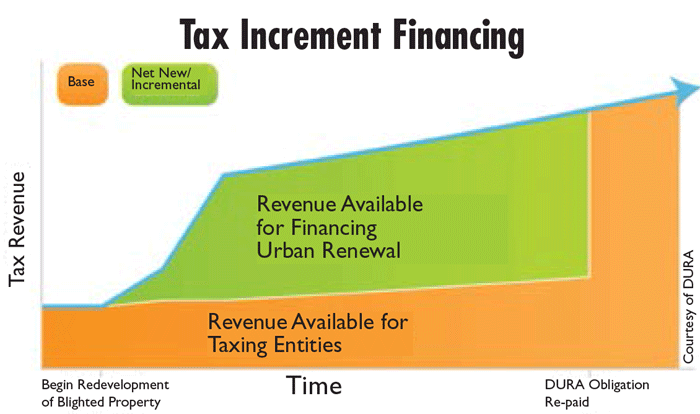

To understand TIF you need to understand the terms “base” and “tax increment.”

The base is the amount of tax revenue that a property was generating prior to establishing the tax increment area.

At Stapleton, most of the land was owned by the city, which doesn’t pay property tax. But there were private businesses that formed a tax base in Stapleton in 2000. On the graphic below, the base is the orange area in the lower left. The Stapleton TIF lasts 25 years, and for that period of time, the Denver taxing entities will continue to get tax revenue, but it will just be calculated from the base.

The additional tax revenue beyond the base that is generated by redevelopment is called the tax increment (shown in green on the graphic). That money goes to TIF for 25 years and is used to finance and build regional infrastructure, such as parks, major streets, drainage, schools, and police and fire stations.

At the end of 25 years, Denver, DPS and Urban Drainage will receive the full revenue from the greatly improved property (shown in orange on the right side of the graphic).

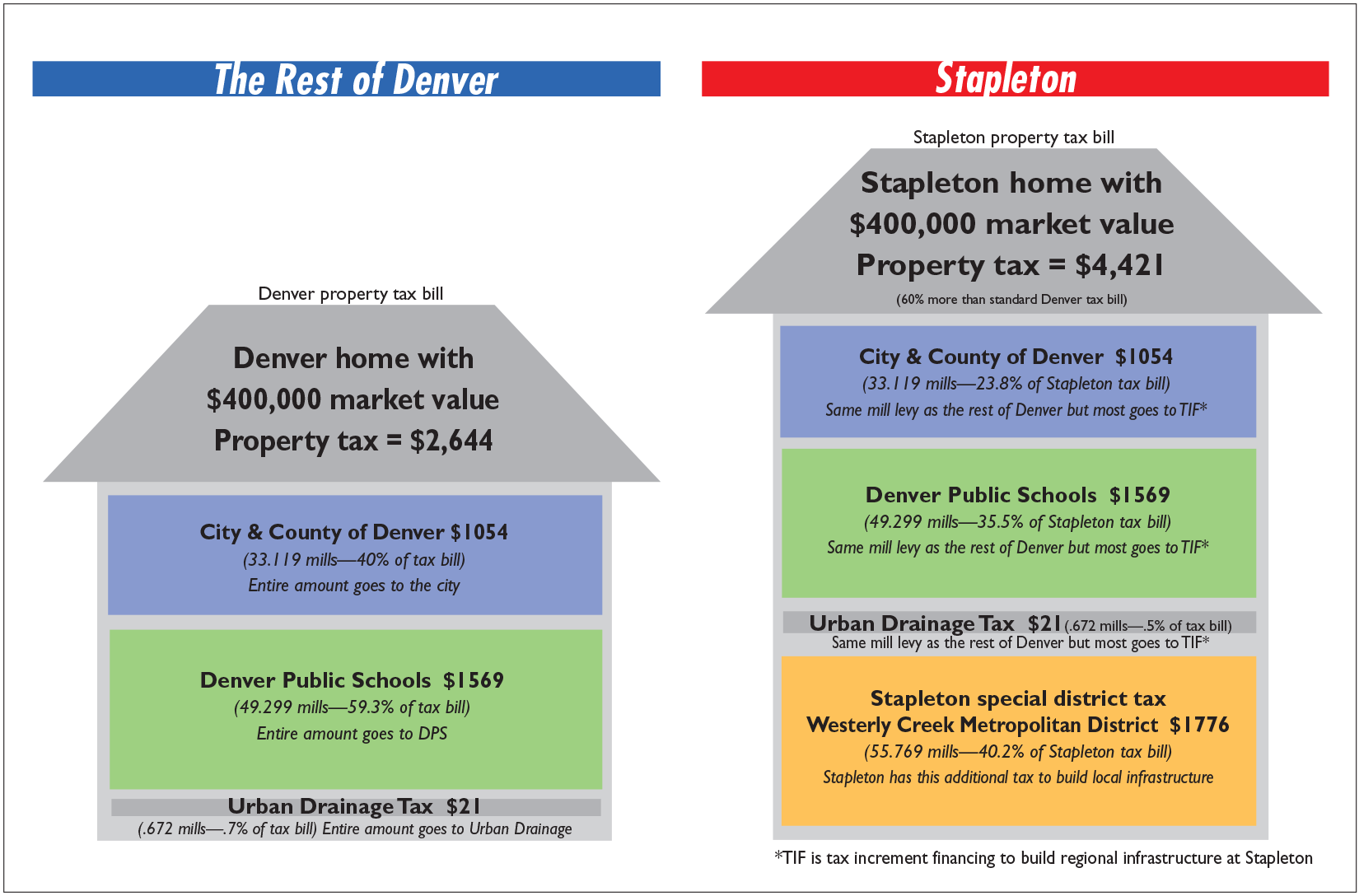

City sales and property tax rates are the same in Stapleton as everywhere else in the city—the difference in Stapleton is that most of the tax revenue goes to TIF rather than going 100% to the city, DPS or Urban Drainage, as it does in non-tax increment areas.

In 2013, $39.9 million in tax revenue went to the base and $369.6 million (the tax increment) went to TIF.

Stapleton Special District Tax

As Stapleton residents know, their tax bill is higher than the rest of the city because it includes an additional taxing entity called Westerly Creek Metropolitan District (WCMD). The revenue from that tax is used to build local infrastructure that is used mostly by Stapleton residents, such as streets in neighborhoods, commercial and industrial areas, pocket parks, pools, and drainage. Unlike TIF, which will end in 2025 with all debt paid off, WCMD has no estimate at this time when their debt will be paid off.

We hope the chart on the next page will help you further understand Stapleton financing. Next month we’ll explain Stapleton land acquisition and development.

Development from 2000-2013

–Six million tons of runway was removed

–Forest City has purchased 2,046 of 2,935 developable acres

–5,529 homes have been sold

–843 apartments have been built

–288 apartments are in development

–17,000 residents (approx.)

–Commercial development:

Office space—approx. 393,00 sf

Industrial/office flex space—1.2 million sf

Retail—2.1 million sf

–$664 million in local/regional infrastructure

(includes parks, schools, I-70 interchange at CPB)

–859 acres of open space have been developed, are

in development or remain in their functional

natural state (a total of 1,116 acres at build out)

– 70 acres of local parks developed or in development

I think it's absurd that the build out of the "local infrastructure" is financed through extra property tax. This is generally borne by the developer. Many (if not most) home buyers in Stapleton are not aware of the incremental tax, so this effectively amounts to a hidden markup of the price of the home, when this would be much more transparent if it were borne by the developer and included in the upfront price of the home (I suspect there would be no material change in the pricing since it is driven by market demand).

Also, given that Stapleton will eventually be built out, when will the incremental WCMD property tax end? There should be a projection.

We are trying to get a projection for when the tax will end and will print it in the paper when we get it.

Couldn’t agree more with your two main points! A further absurdity is that, even though Stapleton home owners are paying extra for this “local infrastructure”, promised infrastructure such as Westerly Creek North Park have yet to be delivered on. Get it done Forest City, WCMD, City of Denver, and Urban Drainage and stop taking our money!

As a refresher about Stapleton taxes:

The “extra” tax paid by Stapleton residents to Westerly Creek Metro District builds “local” infrastructure like neighborhood streets, pocket parks and pools. At this point there is no end date set for that tax. That tax won’t be reduced in the foreseeable future as it pays debt service currently projected out to 2050 (with almost 40% of local infrastructure remaining to be built). Even when the debt is paid (and no date has been projected for that), the tax will continue in perpetuity at the level needed to maintain property owned by PCMD (pocket parks, pools, the greens).

The “regional” infrastructure described in the article is being built with revenue from Tax Increment Financing (TIF). Westerly Creek North, as part of a regional open space area, is being built with TIF funds (and construction is expected to start in January). When TIF ends in 2025, Stapleton residents will continue to pay the same levels of property and sales tax that they pay now, but instead of that tax money going into a fund to build Stapleton infrastructure, it will go to the taxing entity (the city, the schools, Urban Drainage).

I think the city of Denver needs to send all Stapleton residents a Thank You card.

This is a very clear explanation of a complicated issue. It should raise issues for us to think about and also clarify why shopping locally helps our community.