Stapleton resident Chris Adams shows his company’s budget simulation and tax receipt that help Colorado residents get better informed about the state’s budget.

Chris Adams runs a business devoted to better public policy. But he lives in the only state in the country where the governor and legislature don’t control tax rates—only the voters have that power. And the voters have set tax policies that Adams, and many others, believe have created an ungovernable situation.

Governor Hickenlooper, in his state of the state address in January, referred to the constitutional amendments that govern Colorado’s tax policy as a “fiscal thicket.” But the governor has also said he believes that if voters are educated about the fiscal implications of ballot measures, they will be able to make thoughtful decisions that will benefit Coloradans.

Adams just happens to know something about helping the public become informed about budget and taxation issues. His firm, Engaged Public, supported the city of Hartford, Connecticut in its effort to help educate its residents about cuts or tax increases they were facing to resolve their $40 million deficit. “The mayor wanted to engage residents to help him decide what’s most important—if it’s not all cuts, what types of tax increases are available.”

Adams’ company created an online simulation called Balancing Act that allowed Hartford residents to see a simplified view of their city’s budget and submit their suggestions for how to resolve the deficit. In Hartford, the city council and the mayor make these decisions, but, by using Balancing Act, they were able to get public feedback to help guide their decisions.

Adams showed Balancing Act to the Colorado Governor’s Office of State Planning and Budgeting and they decided to use it to educate and get feedback from Colorado residents. Adams says people only need to spend about eight minutes to get a working understanding of the budget, learn where their own tax money goes, and enter their suggested budget changes. When they finish the simulation and hit “submit,” the suggested re-allocation of funds and or/taxes are shared with the Governor’s Office of State Planning and Budgeting.

Adams says a tenth-grader, after spending a short time on the simulation, discovered, much to her dismay, that the state spends almost as much on prisons as on public colleges and universities.

How Colorado’s constitutional amendments control taxes

The Taxpayer Bill of Rights (TABOR), passed by voters in 1992, contains revenue growth restrictions using a formula for taxes that is indexed to inflation and population growth. The formula is based on the prior year’s revenue. It also requires that all tax rate increases be approved by a vote of the people (along with numerous other provisions). TABOR contains the most restrictive tax and spending limits in the country, severely limiting the ability of public officials to adjust the budget to reflect changing needs.

During the 1990s, following voter approval of TABOR, Colorado’s education spending did not keep pace with inflation. Voters then passed Amendment 23 in 2000, a ballot initiative that mandated K-12 funding be increased each year by the rate of inflation.

The combined effect of these two amendments has been likened to pressing the accelerator and the brake at the same time, says Adams. In the simulation, users will get alerts when their suggested changes violate TABOR or Amendment 23. But after the warning, voters have the power to make changes. Under our constitutional amendments, that power is not available to elected officials.

Get your own personal tax receipt

Visitors to www.ColoradoTaxpayerReceipt.com can create their own personalized tax receipt to see just how much of their money will go toward each of about 30 areas in the state budget.

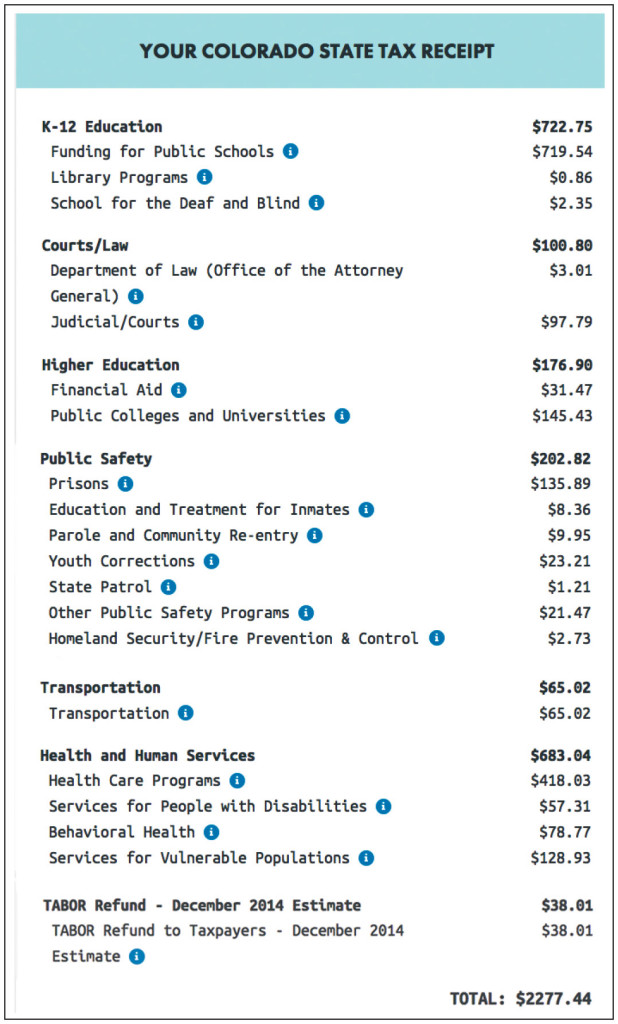

After entering individual or family income and other brief information, the simulation calculates a typical state tax bill based on the data entered. The tax bill at right is based on a 50-year-old with a $60,000/yr. income who drives 8,000 miles a year in a gasoline engine car that gets 40 miles per gallon. Gasoline taxes are calculated based on miles driven and miles per gallon. (Note that electric car owners could drive double that amount but pay no gas tax to maintain the roads since they don’t buy gas.)

The taxpayer receipt also includes “TABOR Refund.” The state currently estimates that in 2015-16 it will return $187 million to taxpayers due to TABOR. The taxpayer shown in the sample tax receipt would pay $38 to help fund this statewide refund, but the actual refund amounts will not be known until policymakers decide how the payments will be distributed.

The taxpayer receipt at left shows a portion of what a 50-year-old with an income of $60,000 will find on the simulation at http://co.abalancingact.com/taxreceipt.

2015-16 Spending and Revenue

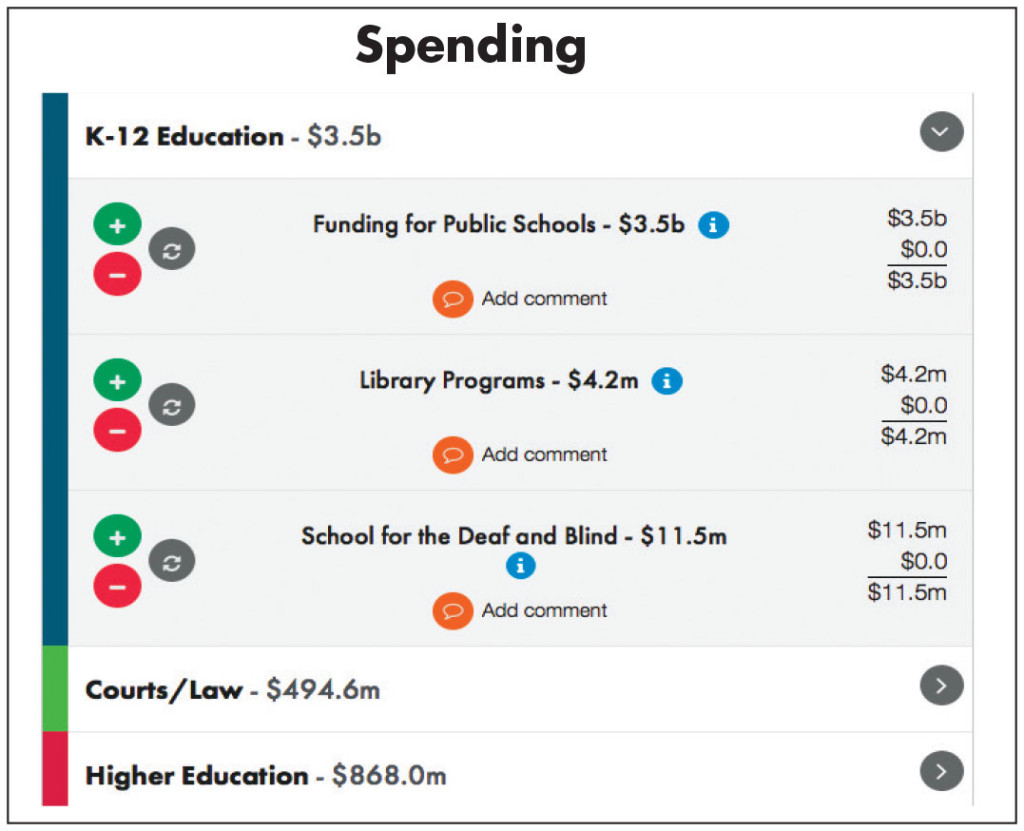

A second section of the website, http://co.abalancingact.com, allows users of the simulation to change the allocation of tax funds according to what they think the state’s priorities should be.

Visitors to Balancing Act can increase funding to K-12 education; allocate more to transportation and higher education; or, cut services to increase refunds. They can also enter comments about each expense and each revenue source.

However, all the spending has to be paid for. On the revenue side of the simulation, visitors who try to raise $14 million by increasing the income tax rate by one one-hundredth of a percent are informed that the Colorado constitution requires a vote of the people before that can happen. After that message, the simulation allows the user to make that change—but even if legislators were to unanimously agree on that change, they would have to put it on the ballot for a vote.

A sample of the spending options in Balancing Act is shown at left. In K-12 Education, the largest expenditure ($3.5 billion per year), simulation users can add or subtract from each of the sub-categories in 1% increments. There is also a place to enter comments that, upon submission, will go to the Governor’s Office of State Planning and Budgeting.

I don’t see % administrative expenses for each of these programs. How much is spent on red tape vs how much is actually doing the work of a program?

According to Adams, administrative costs are factored into the program cost. At the bottom of the tax receipt there is another level of detail for each line item. Visit http://co.abalancingact.com.