December 2012 issue

Solving Colorado’s budget crisis

Colorado’s “Gordian Knot,” refers to three amendments to the state constitution that, taken together, both limit revenue and require increased spending. The combination of these amendments severely limits the ability of the Colorado legislature to efficiently run the state and provide services to Coloradans.

The term “Gordian Knot” refers to an intractable problem solved by a bold stroke. It comes from an ancient legend about a farmer, Gordios, who was named king of a region in what is now Macedonia after an oracle decreed the first man to drive his oxcart into the city would become king. Gordios’ son then tied a complicated knot on the shaft of the oxcart, dedicating it to their people’s god—and the cart remained in the palace for over a hundred years. The knot was supposedly impossible to unravel, but an oracle prophesied that it would be untied by the future king of Asia.

When Alexander the Great arrived in the fourth century BC, he proclaimed, according to the legend, that it did not matter how the knot got undone—and he cut it apart with his sword and went on to conquer Asia.

Here is Colorado’s Gordian Knot:

The Gallagher Amendment of 1982 limits statewide property tax revenue to a formula that is 45 percent homeowner taxes and 55 percent commercial taxes. As the population has grown and property values have increased, residential tax rates have dropped to maintain the ratio. As a result, local property tax revenue to school districts has dropped dramatically.

The Taxpayer Bill of Rights (TABOR), passed in 1992, contains revenue growth restrictions using a formula for taxes that is indexed to inflation and is based on the prior year’s revenue. Cuts that occur during temporary downturns in the economy become permanent (the so-called ratchet effect) due to this formula, which also slows recovery and prevents building up savings in good times. TABOR contains the most restrictive tax and spending limits in the country, severely limiting the ability of public officials to adjust the budget to reflect changing needs.

Amendment 23 was passed in 2000 to reverse the budget cuts that occurred in Colorado school districts in the ‘90s. It called for the state legislature to increase education funding annually by the rate of inflation plus one percent for the first 10 years (and the rate of inflation thereafter), along with other specific provisions to restore education funding.

Amendment 23 requires increased spending at the same time TABOR and Gallagher reduce revenue. The combined effect of these three amendments creates an unsustainable fiscal formula for Colorado, our “Gordian Knot,” that has no solution as long as all three amendments remain in effect. Repeal of any or all of these amendments would require a ballot question to Colorado voters.

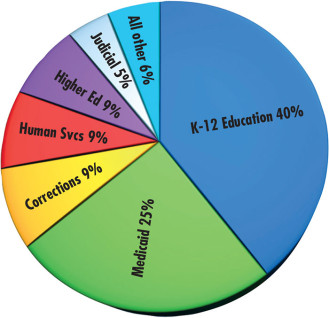

In the 2012-13 state budget, after funds are allocated for the six biggest departments (K-12 education, Medicaid, corrections, human services, higher education and the judicial system) just 5.7 percent of general fund revenue, shown in turquoise, remains to cover other state government expenses. (Numbers on chart are rounded.)

0 Comments