Mayor Hancock says Denver has a housing crisis. He points to the headlines we’ve all seen: Denver’s relentless growth (1000 net new residents per month), the national attraction to both millennials and baby boomers, the sky-rocketing home values and rents, and the increasing number of households who are “cost-burdened,” i.e., those spending more than 30 percent of their income on housing. The current estimate is 87,000 cost-burdened households.

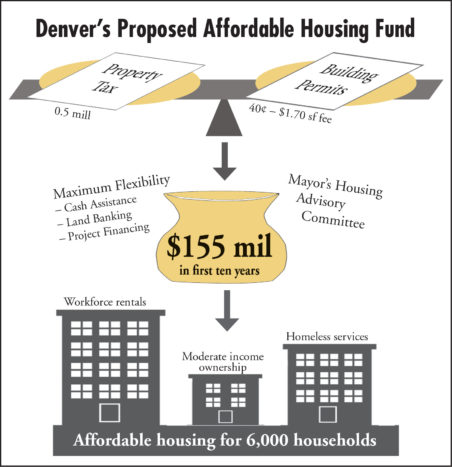

This is why he appeared at North High School on July 21 for a public meeting to explain and advocate for a permanent housing fund that would raise $155 million over the next 10 years to build or preserve 6,000 affordable units.

What are the sources of revenue for the affordable housing fund?

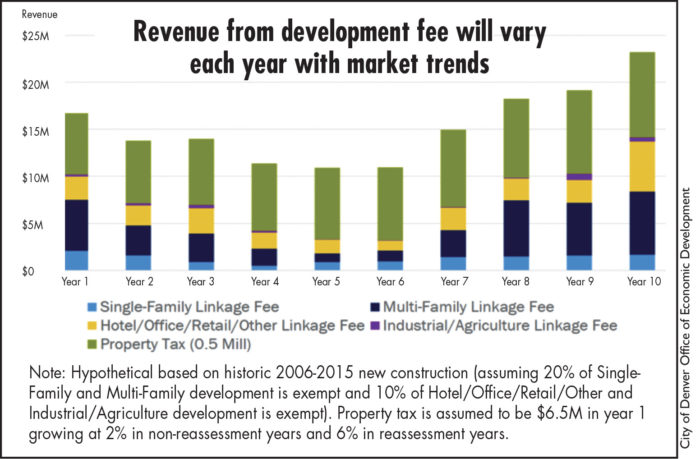

Denver wants to create a permanent and stable fund that would have maximum flexibility (e.g., cash assistance, project financing, land-banking). Persons or households earning 80 per cent or less of the area median income (AMI) would be eligible for rental assistance. Persons or households earning up to 120% of AMI would be eligible for affordable ownership assistance. Funding would derive roughly equally from a 0.5 mill property tax and a development impact (linkage) fee. For homeowners, the property tax rate hike (already approved by voters, now awaiting approval by City Council) would cost about $12 a year on a median home valued at $300,000. Four proposed development fees range from 40¢ to $1.70 per square foot, depending on the type of new building or expansion project. The fee would apply to existing dwellings that are expanded. Exempted projects would include affordable housing projects, government buildings, projects being developed by nonprofits for homeless individuals and replacement homes following catastrophic events. The fees would take effect at time of building permit issuance starting January 1, 2017. Decisions on expenditures of the new funds would be made by a Mayor’s Housing Advisory Committee to be named.

–

–

How would this affect Denver’s current inclusionary housing ordinance?

If approved, the residential development fee would replace Denver’s current Inclusionary Housing Ordinance (IHO) that requires developers of projects with 30 or more units to set aside 10 percent of the units for affordable housing, with a payment-in-lieu opt out. Existing developer agreements would not be affected.

When might this proposal take effect?

This proposal is on a fast track with first council reading of the adopting ordinance set for August 22. Second and final reading of the ordinance would occur August 29 according to the current schedule.

What is the likelihood of this proposal being adopted?

If the July 21 public meeting is any indication, there appears to be strong support from the public for the proposal. Based on instant polling (hand clickers), 90 percent of the 168 participating attendees deemed it “critical” or “important” for Denver to dedicate new local funding for affordable housing. A strong majority also indicated the emphasis for fund use should be on rental housing with only 12 percent advocating its use for homeownership. A large majority also favored increasing the overall fund size by increasing the development impact fee (but not the property tax). The proposal is being spearheaded by the mayor and councilmembers Robin Kniech and Albus Brooks. Councilman Herndon has said he believes this proposal hasn’t been fully vetted and believes August is too soon for council to act.

0 Comments