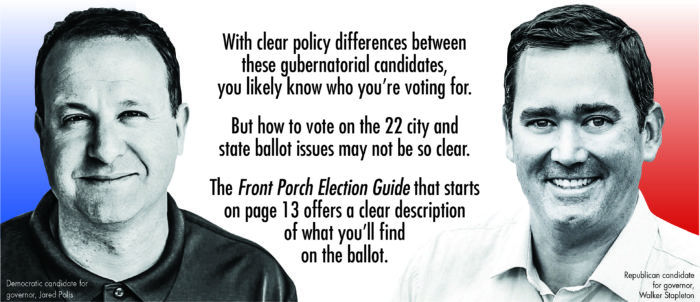

2018 Guide to the Ballot

VOTER INFORMATION

- Ballots must be turned in by Election Day, Nov. 6 at 7pm. You can register and vote at a Voter Service Center (VSC) right up to 7pm on Election Day.

- NE Denver has three Voter Service Centers where you can register or cast your ballot. Hours are Monday – Friday from 10am to 6pm starting October 22. Saturdays from 10am – 2pm starting Oct. 27. And on Election Day they are open 7am to 7pm:

- Central Park Recreation Center – 9651 E Martin Luther King Jr Blvd. Multipurpose Rm

- Hiawatha Davis Jr Recreation Center – 3334 N Holly St Multipurpose Room

- Montclair Recreation Center – 729 N Ulster Way Multipurpose Room

- Locations also have drive-by ballot dropoff boxes that are open 24 hours a day.

- Mailing of ballots to registered voters begins Oct. 15.

Denver Elections Contacts:

720-913-VOTE (8683)

DenverVotes.org

voterregistration@denvergov.org

(for voter registration inquiries)

elections@denvergov.org

(for general election information)

To learn more about the history of Colorado ballot measures, go to: https://leg.colorado.gov/node/966016/.

Understanding Ballot Measures

For this explanation of the 22 ballot measures, the Front Porch called on an expert, Todd Engdahl. Engdahl’s company, Capitol Editorial Services, is a research firm that provides services to lobbying firms and advocacy groups at the Colorado legislature. He’s a former executive city editor of The Denver Post, launched DenverPost.com and was a co-founder of the website Education News Colorado. He says he’s written more ballot measure articles than he can remember.

What’s the difference between an amendment and a proposition?

The ballot measures you’ll read here are either amendments to the state constitution or changes in state law. Constitutional changes are called amendments; changes to state law are called propositions. Constitutional changes require approval by 55 percent of voters—thanks to a successful 2016 ballot measure.

Coloradans have long debated the issue of whether the state constitution has too many amendments, given that once something is in the constitution it takes another statewide vote to change or remove a provision.

In contrast, a new law approved by voters can later be amended by the legislature.

Some groups have long tried to make amending the constitution harder. A successful 2016 constitutional amendment both imposes geographic requirements for gathering signatures and requires a 55 percent vote to pass an amendment. The new signature requirements didn’t seem to deter any amendments this year, and election day results will tell us about the impact of the 55 percent requirement.

Colorado’s constitution is about 45,000 words, higher than the average of about 26,000 words for state constitutions and it far exceeds the 7,591 words in the U.S. constitution.

Measures get on the ballot via initiative and referendum

There are only two ways for measures to get on the ballot. Initiatives are proposals made by citizens (usually advocacy and special interest groups) that have gathered the required number of petition signatures. A measure approved by two-thirds votes of both houses of the legislature is called a referendum.

Here are the state measures that will be on your ballot this election, along with links to full proposal texts and explanations. State proposals are grouped by their significance, not by ballot order.

The Big Measures

NE neighbors attended an information session about Amendment 73 at the Sam Gary Library in September.

Funding for Public Schools – Amendment 73

What it would do – The amendment would generate an estimated additional $1.6 billion in the first full year for school districts by raising income tax rates for individuals who earn more than $150,000 a year and by raising corporate income tax rates. (Current total funding for the state’s 178 school districts is about $9.8 billion in state and local funds.) The amendment also would change the constitution so as to stabilize local property tax revenues for schools – but not other units of local government.

Who’s behind it – Advocacy for the amendment is being led by Great Education Colorado, a citizen group that long has pushed for increased school funding. It’s also strongly supported by various “mainline” education groups – teacher unions and the school boards and school administrator associations.

Context and history – Spending on Colorado schools is governed by three constitutional amendments and a 24-year-old state law that contains the formula for allocating money to school districts.

The complicated interplay of those amendments has created problems and uncertainties. School funding has to increase annually by inflation and enrollment growth under the terms of one amendment. But the terms of another amendment have reduced districts’ local property tax revenues, forcing the state to pick up a greater share of school costs. And because a third amendment controls annual growth in state spending, rising school spending has squeezed other state programs in lean budget years and forced the legislature to create a mechanism that allows it to limit K-12 increases if it needs to do so to balance the budget. That mechanism was upheld by the Colorado Supreme Court a few years ago.

So while school spending continues to grow, many other states have pulled ahead of Colorado in per-pupil support, and in recent years school districts also have been forced to pick up many of the costs of new state requirements.

School district leaders have been increasingly stressed about funding, but two previous proposed tax increases failed, one in 2011 and the other in 2013.

How it would work – On the tax side, the amendment would change the state’s current 4.63 percent income tax rate only for taxpayers earning $150,000 or more a year. Depending on their incomes, the rates would range from 5 to 8.25 percent. The changes would affect an estimated 8.2 percent of taxpayers.

The corporate tax rate, now also at 4.63 percent, would rise to 7 percent.

And the amendment would create a separate property tax system for schools. Under the constitution, residential and commercial assessment rates can fluctuate. For example, the current residential rate is 7.2 percent but is expected to slide to 6.1 percent. The commercial rate is 29 percent.

The amendment would fix the residential rate at 7 percent and the commercial rate at 24 percent. However the impacts for taxpayers would vary widely because property valuations and tax rates are very different from school district to school district. The fluctuating system of assessment rates would remain in place for counties, cities, fire districts and other local governments.

On the spending side the amendment would require the legislature to create a new school funding formula to increase base per pupil funding, ensure equitable funding among districts, provide additional funding for certain specialized and early childhood programs and also provide support for the recruitment and retention of teachers.

Pros and cons – Broadly, proponents believe more school funding is needed to restore cuts made after the 2008 recession and to meet the needs of a student population that’s more diverse than in the past. They point to low teachers salaries and the larger number of districts on four-day weeks as examples of the need.

While there isn’t organized opposition, critics of increased school funding argue there’s no guarantee that more spending will improve academic achievement, believe schools should more efficiently spend the money they receive now and that higher taxes would hurt Colorado’s economy.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_93final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_2017-2018%2093v3.pdf

Energy Development –Proposition 112 & Amendment 74

This photo of a well pad being constructed near Erie was on the front page of the Front Porch in February 2018, when the neighborhood learned that an area in Stapleton was being considered for drilling. —Photo by Evan Anderman

Colorado’s long-running debate over energy development has moved to the voters this year with two measures.

Proposition 112 – Setback requirements for oil and gas operations

What it would do – This proposal would require oil and natural gas extraction facilities be located at least 2,500 feet from occupied structures, water sources and other “vulnerable” areas.

Who’s behind it – A group named Colorado Rising is the main organization behind the plan, which also is backed by environmental groups and neighborhood activists along the northern Front Range.

Context and history – This s the latest clash in the long running grudge match over appropriate energy development between neighborhood groups and local governments on one side and well-funded oil and gas interests on the other. The battle has raged before state regulators and city councils, through the halls of the legislature and in state courtrooms. The energy industry has maintained that current regulations are more than sufficient and that uniform regulation by the state is best. Their opponents have been stymied in their efforts to allow local regulation of drillers, so the setback proposal is their latest effort.

How it would work – The Colorado Oil and Gas Conservation Commission currently requires wells and production facilities be at least 500 feet from homes or other occupied buildings and 1,000 feet from schools, hospitals, other high occupancy buildings and neighborhoods with at least 22 structures. Those setbacks can be waived in certain circumstances. The initiative would increase the setback to at least 2,500 feet, include water sources and other areas state and local governments designate as vulnerable and not allow waivers.

Pros and cons – Supporters believe oil and gas operations present health and safety risks from emissions, leaks, explosions and other hazards and so should be located farther from homes, businesses, schools and other development. Opponents believe such safety concerns are overstated, but they primarily are stressing the argument that the initiative would effectively ban energy development on 85 percent of non-federal land in Colorado, thereby decimating the energy industry, harming the economy and reducing tax revenues.

Full text: http://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/filings/2017-2018/97Final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/final_draft_packet_-_initiative_97.pdf

Amendment 74 – Compensation for government-caused losses in value of property

What it would do – The amendment would broaden the kinds of government actions that require compensation of private property owners for loss of property value.

Who’s behind it – The Colorado Farm Bureau and the Oil and Gas Industry.

Context and history – This proposal is an opposing idea to Proposition 112.

Amendment 74 would require a government to compensate a property owner for a decrease in the market value of property caused by any regulatory action. Specifically, if a local government puts restrictions on energy development that mean a mineral rights owner can’t fully develop an oil field, the property owner would have to be compensated.

How it would work – Most of us are familiar with “eminent domain,” the legal procedure that allows a government to condemn a lot you own, pay you for it and then run a new street through that parcel. Legal precedent also requires a government agency to pay you if some other action results in almost total loss of a property’s value.

This amendment broadens the circumstances under which property owners would have to be compensated.

The farm bureau supports this because lots of farmers, especially in northeastern Colorado, earn money from energy companies that develop oil and gas beneath their land.

Pros and cons – The energy industry and farmers say the amendment provides basic fairness, but environmental groups and the Colorado Municipal League strongly oppose it, warning of unintended consequences and hamstringing of local government. Gov. John Hickenlooper also opposes the amendment.

Full text: http://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/results/2017-2018/108Results.html

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_2017-2018%20108v3.pdf

Transportation Funding –Proposition 110 & Proposition 109

Voters face competing measures on how to pay for improvements to Colorado’s stressed highway and transportation systems, an issue that has bedeviled the legislature for several years but hasn’t been resolved to the satisfaction of various interest groups.

Proposition 110 – Transportation Funding with Tax Increase

What it would do – This plan would allow the state to borrow up to $6 billion for transportation projects by increasing the state sales tax to 3.52 percent for 20 years, up from 2.9 percent.

Who’s behind it – The Denver Metro Chamber of Commerce and other major business interests are the prime backers on the plan.

How it would work – The additional sales tax would allow borrowing of up to $6 billion, with repayments costs of $9.4 million over 20 years. The new revenue would be distributed along these lines – 45 percent for the Colorado Department of Transportation, 40 percent to local governments and 15 percent for “multi-modal” transportation projects.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_153final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20proposition%20110.pdf

Proposition 109 – Transportation Funding without Tax Increase

What it would do – This plan requires the state to borrow up to $3.5 billion in 2019 to fund 66 already-specified state highway projects.

Who’s behind it – John Caldera of the conservative Independence Institute think tank. Known for his colorful language, he’s dubbed it the “fix our damn roads” plan.

How it would work – In contrast to the chamber’s plan, this measure would require the bonds be repaid without raising taxes or fees, perhaps affecting what lawmakers can spend on other programs. The maximum allowed repayment amount would be $5.2 billion over 20 years.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_167final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20proposition%20109.pdf

Comparing Propositions 110 & 109

Context and history – Colorado lawmakers and interest groups have been fighting over this issue for years. Everyone agrees the state needs to spend more money on highways and other transportation needs, but there’s disagreement over how to pay for it. Business groups and Democrats believe increased tax revenue is needed for transportation to avoid squeezing current spending on education and health care for the poor. Republicans and conservative pressure groups believe bonds can be paid off from existing state revenues, and many think the state spends too much on Medicaid.

The 2017 and 2018 legislative sessions provided modest increases in transportation funding, but not enough to satisfy advocacy groups. One of those legislative initiatives allows borrowing with bonds backed by the value of some state buildings.

Pros and cons – Both measures want to do the same thing, just with different amounts and sources of money and for different projects. How one votes depends on your feelings about those different methods.

Scenarios – Having two different measures on the same subject creates complications depending on what voters decide. Here are the possibilities:

If the no-tax plan passes and the other fails, then the legislature will have to cancel most of its $1.5 billion bond plan passed in 2017, but the no-tax plan would fund only $2 billion in additional projects.

If the tax plan passes and the no-tax initiative fails, both the legislature’s 2017 plan and the new spending go into effect.

If both pass, both spending plans would go into effect, but the whole thing could end of up court.

Defeat of both measures would trigger a 2019 ballot measure asking support of another, $2.3 billion legislative bonding plan. (This fallback plan is part of a plan passed by the 2018 legislature.)

Congressional and Legislative District Boundaries – Amendment Y & Amendment Z

Redrawing congressional and legislative district boundaries after each federal census long has been a bitterly partisan process and often has ended with judges making the decisions. This year the political parties and the legislature have united behind two plans to end all that. Now it’s up to the voters.

Amendment Y– Congressional Redistricting

What it would do – Create an independent, politically balanced Congressional Redistricting Commission to draw new boundaries for the state’s congressional districts following the U.S. Census every 10 years.

Governor Hickenlooper gives the 2016 State-of-the-State Address to the members of the State House and Senate, the Colorado Supreme Court and other government officials.

Context and history – The constitution currently gives the legislature the responsibility for drawing congressional district boundaries. If lawmakers can’t agree the courts step in, which has happened during the last four redistricting cycles. Various, and competing, plans for changing the system have been proposed in recent years. The major political parties and other groups finally agreed on the plan that became Amendment Y.

How it would work – The commission would have 12 members, four from the state’s largest political party (Democratic now), four from the second largest party (Republican) and four unaffiliated.

Commissioners would be selected by a panel of retired judges from the state supreme court and court of appeals. Those judges would winnow the applicant pool twice and then randomly select commission members. (Four members would be selected from a pool chosen by legislative leaders.) The amendment sets various qualifications for commissioner applicants and bans recent candidates, lobbyists, current officeholders and some others from applying.

The commission would consider maps prepared by non-partisan legislative staff and the public, hold public hearings and select a final map approved by at least eight commissioners, including at least two of the unaffiliated members. The amendment sets criteria the commission must consider in drawing districts. The commission’s final map would have to be approved by the Colorado Supreme Court. If the commission couldn’t agree, staff would submit a map to the court.

Pros and cons – Proponents of the commission idea argue that it would be less partisan, more transparent and more structured than the current system. Opponents believe the idea removes accountability, because none of the participants in the new process would be elected and accountable to voters, and that it’s too complex and could lead to unintended consequences.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_yfinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_scr%2018-004v3.pdf

Amendment Z – Legislative Redistricting

What it would do – Create an independent, politically balanced Legislative Redistricting Commission to draw new boundaries for the state’s legislative districts following the U.S. Census every 10 years.

Context and history – The existing, eleven member Colorado Reapportionment Commission prepares maps for the 100 state Senate and House districts and submits them to the Supreme Court for approval. Commission members are appointed by the governor, legislative leaders and the chief justice. But up to six members of the commission may belong to the same political party.

How it would work – Provisions setting the size, appointment of members and operations of the new commission are the same as specified for the congressional commission.

Pros and cons – Broad arguments for and against the two measures are similar.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_zfinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20amendment%20z.pdf

Other Proposals of Note

Amendment 75 – Limits on Some Campaign Contributions

What it would do – Under this proposal, limits on individual campaign contributions would be waived in races where one or more candidates have spent $1 million or more on their own campaigns.

Who’s behind it – Greg Brophy, a former GOP state senator and unsuccessful candidate for governor, is the public face of this proposal.

Context and history – Colorado has a complicated set of campaign contribution limits in the state constitution, but there is no limit on the amount of money a wealthy candidate can contribute or loan to his or her own campaign. In the last eight years four candidates in statewide races have contributed or loaned more than $1 million to their own campaigns.

The most recent examples are Jared Polis, the current Democratic candidate for governor, and Victor Mitchell, who was defeated in the Republican gubernatorial primary.

How it would work – The current limit on individual contributions to statewide candidates is $1,150. If a candidate contributes or loans $1 million or more, that limit would increase to $5,750. (In some cases, $1 million contributions to outside campaign committees also would trigger the increase.)

Pros and cons – Supporters of the idea argue the amendment would level the playing field in races with rich candidates, but opponents warn passage actually just inject more money into state races and further complicate an already-cumbersome and somewhat opaque finance system.

Full text: http://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/filings/2017-2018/173Final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_2017-2018%20173v3.pdf

Proposition 111 – Regulation of Payday Loans

What it would do – Under this initiative, the annual interest rate on payday loans would be limited to 36 percent and the definition of unfair trade practices concerning such loans would be expanded.

Who’s behind it – A group named Coloradans to Stop Predatory Payday Loans is promoting the measure, which also is supported by some economic justice and consumer protection agencies.

Context and history – Payday loans got their name because they’re often used by people who need cash to pay bills between pay checks. The idea is you take out a short-term loan to pay bills and then pay it back after you get paid. In the real world the high interest rates and fees charged by payday lenders make it hard for many borrowers to pay off in full, meaning their debts mount month after month. Current interest rates can be as high as 180 percent. Several states have set the 36 percent limit, but regulation efforts have failed in the Colorado legislature.

How it would work – The amendment would limit annual interest to 36 percent, eliminates fees currently charged by lenders, and impose the limits on lenders who don’t have physical offices in the state but who operate online.

Pros and cons – Advocates long have argued that payday lending victimizes low-income people and needs tighter controls. The industry argues that it’s providing a service for people who need loans but can’t get them elsewhere because of poor credit records. (Payday loans generally don’t require credit checks.)

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_126final.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20initiative%20126.pdf

The Rest of the List

Amendment A – Prohibition of Slavery and Involuntary Servitude

What it would do – A yes vote would remove old language from the constitution that would appear to allow “slavery and involuntary servitude” as punishment for crime.

Who’s behind it – The primary backers are legislators, mostly Democrats, who are uncomfortable with the mention of slavery in the state constitution.

Context and history – This involves old language that goes back to the 19th century, wording that’s also in the U.S. constitution. Courts have ruled that required convict work programs are allowed under both the state and federal constitutions. A previous version of this was defeated by voters in 2016, apparently because of widespread confusion about the wording.

How it would work – This is a simple removal of language.

Pros and cons – Supporters argue the constitution shouldn’t contain any references to slavery. There’s no apparent opposition.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_afinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20amendment%20a.pdf

Amendment V – Age Requirement for Members of the Legislature

What it would do – Reduce the age requirement to serve in the legislature from 25 to 21.

Who’s behind it – Proposed by the legislature.

Context and history – This was proposed a decade ago but was defeated by voters. Some states set the minimum age at 18; it can be as old as 30 in other states.

How it would work – The new age requirement would be in effect for the 2020 legislative elections and for filling legislative vacancies before then.

Pros and cons – The argument made for this is that people who are full citizens otherwise should be able to serve at the Capitol. The traditional argument on the other side is that legislative service requires a bit more maturity.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_vfinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20amendment%20v.pdf

Amendment W – Ballot Format for Judicial Elections

What it would do – Streamline language on the section of the ballot where judges up for retention are listed.

Who’s behind it – Proposed by legislature

Context and history – In Colorado judges don’t run in competitive elections. Rather, they are appointed to the bench and serve terms. When one term ends, a judge’s name goes on the ballot and voters can vote yes or no on whether the judge should be “retained” on the bench.

How it would work – Particularly in larger counties, a lot of judges are on the ballot every election. The constitution currently requires this question to be printed for each judge: “Shall Judge John Doe of the [name of court] be retained in office?”

Under the amendment there would be a single question reading “Shall the following judges of the [name of court] be retained in office?, followed by a list of names.

Pros and cons – The proposal could somewhat shorten Colorado’s long ballots, but some observers worry the language change could confuse voters.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_wfinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_final%20draft%20packet%20-%20amendment%20w.pdf

Amendment X – Definition of Industrial Hemp

What it would do – The proposal would remove the definition of industrial hemp from the state constitution.

Who’s behind it – Hemp producers. The amendment was placed on the ballot by the legislature.

Context and history – Hemp is a botanical relative of marijuana that has very little THC, the “active” ingredient in marijuana. Hemp fibers have a wide variety of industrial and consumer uses, and hemp farming is a growing industry. The definition, which sets a maximum level of THC, was placed in the constitution as part of the broader 2012 constitutional amendment that legalized recreational marijuana.

How it would work – The definition of industrial hemp would become part of state law so could easily be changed by the legislature to meet changes in federal law

Pros and cons – Supporters say taking the definition out of the constitution would enable the state’s hemp industry to stay competitive with other states as regulatory changes are made. There’s no opposition.

Full text: https://leg.colorado.gov/sites/default/files/initiative%2520referendum_xfinal.pdf

Legislative staff analysis: https://leg.colorado.gov/sites/default/files/final_draft_packet_-_amendment_x.pdf

Denver Ballot Measures

Westerly Creek Park in Stapleton, designed both for recreational use and for flood control, successfully kept the storm water from a hundred-year flood in September 2013 out of streets and basements.

Denver ballot measures usually have a lower profile that state initiatives, but city proposals deserve close review because they regularly propose tax increases.

This year four measures propose sales tax increases. Purchases made in Denver currently are subject to 7.65 percent sales tax, including state taxes and non-city taxes like RTD. If all four proposed taxes pass, the combined total in Denver would rise to 8.23 percent.

Breaking through the 8 percent level may give you pause, but it’s by no means unusual. Many suburban cities and Colorado Springs already have higher sales tax rates, and the steepest in the state is Winter Park’s 11.2 percent.

Total 2019 revenue from the four measures, if passed, would be about $116 million. The city’s overall budget is about $2 billion.

Measures Proposed by City Council

Referred Question 2A – Trails and Open Space Tax

The proposal increases the sales and use tax by a rate of 0.25 percent and dedicates the revenue to fund Denver parks, trails and open space. The measure is expected to generate nearly $46 million if adopted.

Initiative Signature Requirements – Referred Question 2B

Currently, petitions for city ballot measures must contain a number of signatures equal to or greater than 5 percent of the total vote for mayor in the most recent previous election. This plan changes the petition signature requirement to 2 percent of the total number of active city registered voters as of Jan. 1 of the most recent odd- numbered year. The proposal is intended to smooth fluctuations in signature requirements that are caused by varying turnout in mayoral elections. The requirement has fluctuated between 4,000 and 6,000 signatures since 2003.

The plan would raise the requirement for the 2019 municipal election from about 5,000 signatures to more than 8,000 because of the city’s population growth and the fact that the 2015 mayoral vote was relatively quiet.

Referred Question 2C – Qualifications for lateral police hires

The amendment would allow applicants for the police department who already are certified as peace officers through another agency and have a minimum of two years’ experience to start the Denver Police Academy at the rate of pay for police officer 2nd grade, followed by faster promotion to 1st grade after graduation. Similar provisions would apply to applicants with four years’ experience.

Referred Question 2D – Authority for City Clerk to Make Appointments

The amendment makes the elections director a civil service employee rather than an appointee of the city clerk. The amendment also gives the clerk the flexibility of two additional hires to address the office’s changing needs.

The measure is considered a routine reclassification of the job into a more appropriate civil service category of city employment.

Referred Question 2E – Matching Fund for Campaign Contributions

This ordinance replaces a similar ordinance that would have appeared on the November 2018 ballot as a citizen initiative. The ordinance puts new lower limits on campaign contributions and creates a public financing mechanism whereby a participating candidate would receive a 9-to-1 match on contributions.

The measure would lower per-donor contribution limits from $3,000 to $1,000 for mayoral candidates; from $2,000 to $700 for candidates for auditor, clerk and the two at-large council seats; and from $1,000 to $400 for the council’s 11 district seats. Those new amounts would be pegged to inflation.

The city also would have to allocate about $2 million a year to a Fair Elections Fund, with a cap set at $8 million. The city would provide $450 for every $50 donation raised by participating candidates, who would have to agree to even lower contribution limits and participate in debates.

Measures Placed on Ballot by Petition

Initiated Ordinance 300 – College Affordability Fund

The proposal increases the sales and use tax by a rate of 0.08 percent and dedicates the revenue to fund college scholarships and support, including career and academic counseling, tutoring, mentoring and financial aid. The ordinance creates a nonprofit to direct the revenue. It would raise about $14 million.

Initiated Ordinance 301 – Caring 4 Denver

The measure increases the sales and use tax by a rate of 0.25 percent and dedicates the revenue to expand funding for mental health services and treatment for children and adults; suicide prevention programs; opioid and substance abuse prevention, treatment and recovery programs; housing and case management services to reduce homelessness, improve long-term recovery and reduce the use of jails and emergency rooms for those with mental health and substance abuse needs. The ordinance creates a nonprofit to direct the revenue.

Initiated Ordinance 302 – Healthy Food for Denver’s Kids

The initiative increases the sales and use tax by a rate of 0.08 percent and dedicates the revenue to provide resources for the Healthy Food for Denver’s Kids Initiative. The ordinance creates a Denver Food Commission to direct the revenue.

But Wait, There’s One More…

Ballot Issue 7G – Urban Drainage and Flood Control District Property Tax Increase

Voters in Denver and several suburban jurisdictions will decide on a property tax increase proposed by the Urban Drainage and Flood Control District, which manages and oversees drainage and flood control infrastructure in the metro area.

When it was created in 1969 the district was given the power to levy a property tax of one mill. The automatic ratchet-down provisions of the Taxpayer’s Bill of Rights have shrunk that tax rate to .56 mills, reducing district revenue by $23 million.

The district is asking voters to restore the original 1 mill rate.

The overall tax rate for Denver homeowners is about 77 mills, including city, school district and other taxes. So raising the drainage district’s levy would have minimal impact on tax bills.

I support Proposition 112 because I know from my own experience that the oilfield as an industry is not concerned with the well being of its employees and is much less concerned with the health of the public.

I first worked on the oil rigs running casing in West Texas. Then later I unloaded trailers full of empty sacks that had contained materials used to make drilling fluid. While unloading these trailers at the landfill, I would breathe in these powders. I would ask for protective gear repeatedly, but it was not provided/replaced on a regular schedule. I started noticing that I produced a lot more phlegm, that my lungs felt full of mucus and I was always coughing it up. These are symptoms that I still have to this day.

I think that there are many oil workers who have experienced their health deteriorating but fear to get tested. There is also a cultural aspect to this: many men of color feel that our worth is connected to toughness, and this depends on our ability to work. I realize that there is also an oil field sub-culture that discourages workers from getting tested. I ended up leaving the oilfield because I knew that I was causing damage to my body.

Now we have the opportunity to stand up for health and safety by keeping these damaging oil and gas fracking operations farther away from our homes and schools. Please vote Yes on Proposition 112 – Safer Setbacks from Fracking.

Miguel Ceballos-Ruiz

Candidate for Denver City Council District 8