Brenna Farrell, after homeschooling, says, “I wish they [teachers] could get paid a million dollars. She is shown here with Conor, 10, Beatrice, 7, and her husband Patrick.

…Voters will decide whether to repeal this amendment.

In the chaos that came from homeschooling two children during a pandemic, Brenna Farrell had a running joke with her husband. Overwhelmed and weary, she would look at him and state the obvious: “We are not thriving.” It created a moment of levity in what had otherwise become an ubiquitous American scene—parents once used to a morning commute or a library story hour were now relegated to the kitchen table teaching common core math and social studies, often while working from home themselves. Farrell’s day consisted of simultaneous Zoom calls, homework checks, IEP meetings, ESL lessons—and then on top of that—more Zoom calls. “It was a lot,” Farrell says, but admits she came away with a deeper understanding of her children’s academic strengths and struggles. It also strengthened her empathy muscle. “You really know [now] how hard they work. Most of my kids’ teachers have kids, so they’re managing their own children plus a classroom of online learning. They’re honestly our heroes. I wish they could get paid a million dollars.”

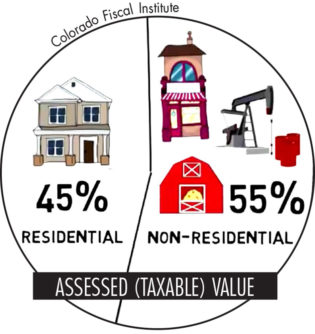

A million might be a pipe dream, but this November there will be a ballot measure designed to ramp up revenue for Colorado schools. The bipartisan measure, which was sponsored by two Republicans and backed by at least a dozen more, asks voters to repeal the Gallagher Amendment, a 1982 law that has done two things: kept residential property taxes low and withheld billions from Colorado schools and special services. The Gallagher Amendment, designed to ensure that businesses pay their fair share in taxes, mandates that statewide property tax revenue must be 45 percent homeowner taxes and 55 percent commercial taxes.

As the population has grown and property values have increased, residential rates have dropped to maintain the ratio. According to the Joint Budget Committee, Gallagher could trigger an 18% residential property tax cut next year—which would mean an additional $491 million in cuts to schools and $204 million in cuts to county governments.

The Gallagher Amendment requires that total tax revenue be divided 45% – 55% between residential and business taxes.

To fully understand Gallagher, you have to understand its entanglement with three other amendments. It’s complicated. Just like teaching one kid literacy, while attending a Zoom IEP meeting for another, while writing a report for your boss, while trying not to burn the spaghetti on the stove is complicated. Like Gallagher, TABOR (Taxpayer Bill of Rights) often limits revenue through its provision that taxes cannot be increased without a vote of the people. The Senior Homestead Act, by giving a tax exemption to senior citizens and others, also restricts revenue. Conversely, Amendment 23 calls for the legislature to increase educational funding annually by the rate of inflation plus one percent. This leaves Colorado with three parts of the constitution that suppress the ability to collect revenue and one that demands an increase in expenditures. Lois Court, a former state senator who spent much of her career trying to untangle this fiscal knot (often called the Gordian Knot), says, “It’s like having one foot on the accelerator and the other on the brake.”

Rep. Daneya Esgar, one of the bill’s sponsors, says “We’ve had to ratchet down the residential rates to 7.15%. That’s an issue. We heard the assessment rate was going to drop next year to 5.88%. Ask your local law enforcement, ask your local fire departments, ask your local school districts what that drop will do to their budgets. You think we’re living in hard times now, folks? [If we don’t repeal], your communities are going to feel an impact.”

Former State Sen. Lois Court, shown here speaking in Park Hill about a ballot question in 2019.

Court echoes that sentiment about the impact on schools, libraries, fire departments, and other public services. She says Gallagher “makes it so rural Colorado has no money because they don’t have the kind of commercial property we have on the Front Range. We need to repeal Gallagher so we can get a more equitable property tax structure into place.”

However, the measure isn’t without opposition. Rep. Rod Bockenfeld says, “Gallagher is doing exactly what it’s supposed to do. If you want to look at some of these districts who are screaming because their residential assessed valuation has gone down…look at the real numbers. They’ve grown their revenue every year. My Democratic colleagues don’t believe their constituents should have a right to determine what level of service they desire from their special districts….if you believe the local people get to determine the level of services they’re willing to pay for…let this remain a local issue. I’m gonna call this what it is—a money grab.”

Michael Fields, Executive Director of the conservative group Colorado Rising Action, tweeted [the Gallagher repeal] “will be a property tax increase for the residential side…Why would we be raising taxes during a recession?”

The Democrats have responded to that argument by citing TABOR’s limitation on tax increases and by introducing a companion bill that would freeze the current assessment rate for four years at 7.15%. The counterargument is that legislators could repeal the freeze and rubber-stamp a new rate.

Understanding the impact of repealing the Gallagher Amendment is complicated. Voters will need to do their homework to make an educated vote on this November ballot question. A video about the Gallagher amendment can be found at www.coloradofiscal.org/video-library.

0 Comments