To download a larger version click here.

Revenue FROM TIF

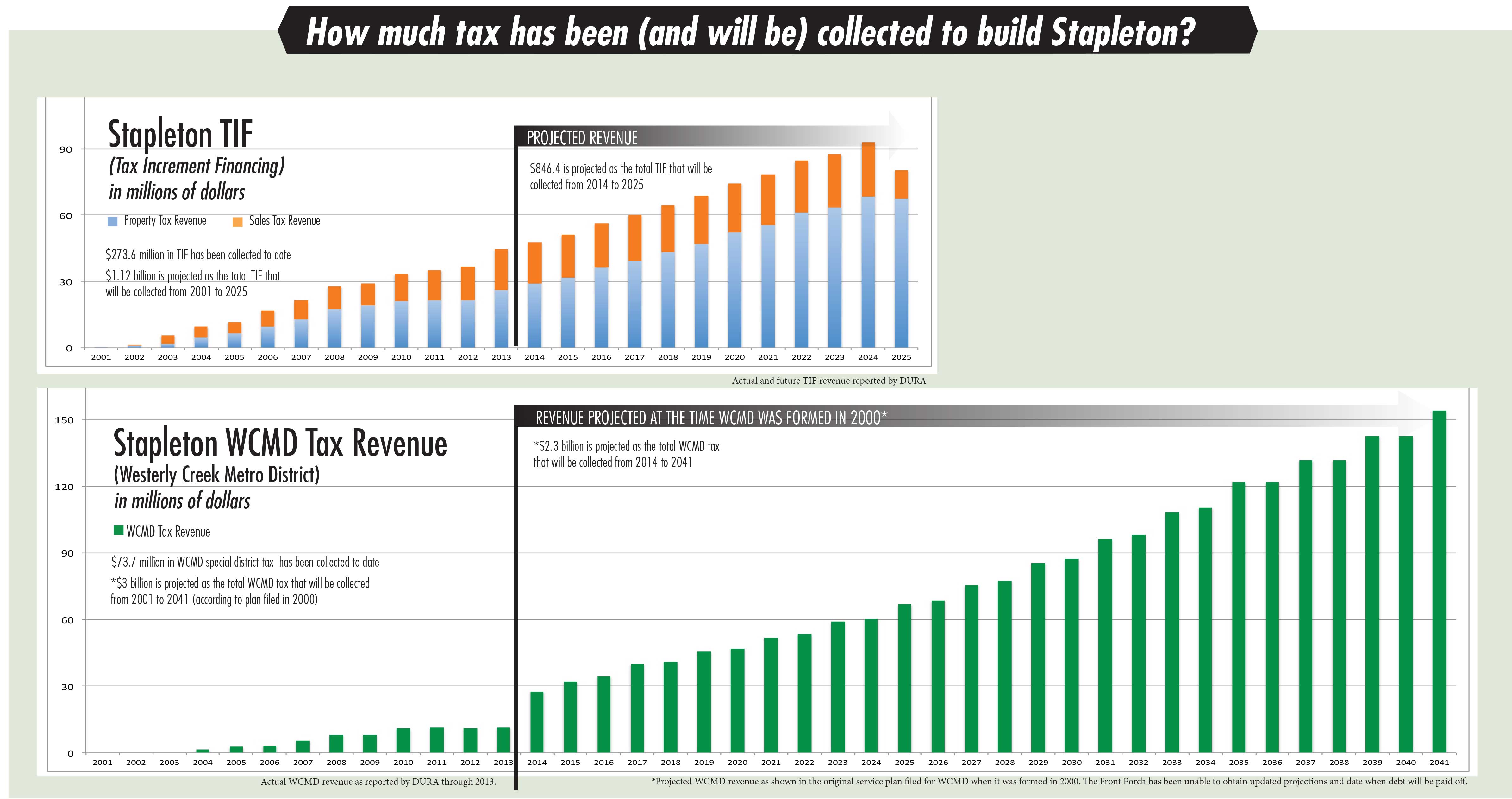

The TIF (Tax Increment Financing) chart (top) shows the amount of property and sales tax increment collected. Stapleton residents pay the same amount of property and sales tax as other Denver residents, but under the TIF plan, for 25 years, tax revenue generated by new development is used to pay for regional infrastructure in Stapleton. Tax revenue generated by the base value (before the new development started) continues to go to the original taxing entities and is not shown on the chart.

The development plan for Stapleton (the Green Book) projected that infrastructure expenses would break down approximately as follows:

- Roads—38%

- Sewer & Drainage—12%

- Open Space & Recreation—23%

- Community Facilities

- (including schools—28%)

Projected funds for the remaining life of the TIF will be spent in a similar way, except the five schools called for in the TIF plan have already been funded, so the only remaining community facility is a fire station north of I-70. (The high school is being built with bond proceeds, not TIF revenue.)

TIF revenue is collected by Denver Urban Renewal Authority (DURA).The projected TIF revenues are derived from a 2012 market report authored by an independent consultant. The projections took into account current market conditions, past performance, and expected development as indicated by Forest City. DURA customarily undertakes market reports in connection with future debt issuances.

How has the TIF revenue been spent?

In-progress/completed infrastructure:

- $182,000,000 Regional infrastructure (primarily roads, open space, drainage)

- $32,000,000 Westerly Creek Elementary and Bill Roberts Elementary/Middle School

- $18,000,000 Community facilities (fire station & improvements to Police Academy, & Quebec St..)

- $18,000,000 Swigert McAuliffe School

- $ 4,000,000 Regional infrastructure in Conservatory Green

- $56,000,000 Isabella Bird Elementary and Northfield school for K-8

- $312,000,000 Total Regional Infrastructure to date

Other expenses paid with TIF revenue:

Bond issuance and debt service—Just as a mortgage incurs upfront expenses and requires payments

to principal and interest, TIF funds are used to issue bonds and pay interest on them, and pay interest

on loans from Forest City and other sources.

City retained tax—Currently 22% of TIF revenue is paid to the City of Denver to provide city services for Stapleton including police, fire, libraries, and parks and rec. From 2015-2019, 30% of TIF will be paid to the city; and from 2020-2024, 47% will be paid to the city. In June, 2025, TIF revenue for Stapleton development ends.

Other revenue for Stapleton infrastructure—Forest City has paid $26 million in System Development Fees, as stipulated in their contract, to build parks and open space. In addition, Forest City and DPS have made loans to move infrastructure projects forward when TIF funds weren’t available. Also, Forest City has made contributions.

When will Stapleton’s taxes mirror our neighbors in Parkhill/ Denver?

The answer is never. Stapleton will always be a special district and have a special district tax over and beyond the City of Denver taxes. When all the debt is paid off Stapleton will still need the tax for repair and maintenance of local infrastructure (alleys, pocket parks, pools). In the next few months the Front Porch will request an update on the debt payment schedule. You’re not the only one who has asked this question recently.

Thank you for this information. Has FP had an update on the debt repayment schedule? Who/what is the entity that would provide this information?