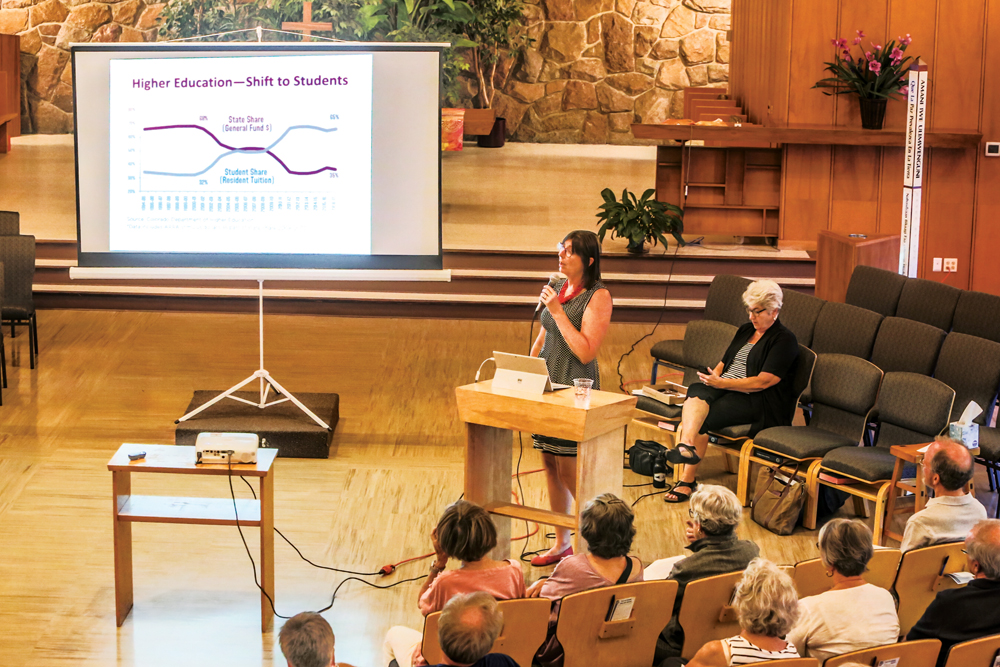

Carol Hedges (left), Executive Director of the Colorado Fiscal Institute and State Senator Lois Court explain Proposition CC at a community meeting on Sept. 4. Learn about all the questions that will be on your Nov. 5 ballot in our article by Todd Engdahl starting on page 6.

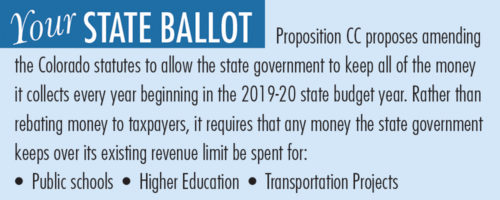

What Proposition CC Would Do

The Taxpayer’s Bill of Rights

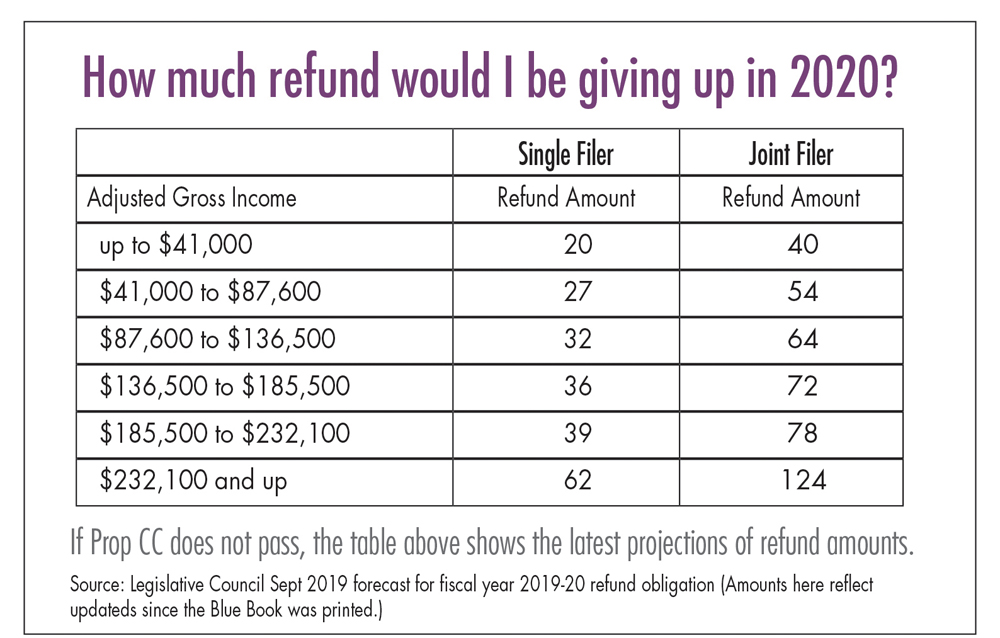

(TABOR) currently sets annual limits on growth of state spending, so revenues above that amount must be refunded to taxpayers. TABOR allows voters to override those limits, and that’s what Proposition CC is asking citizens to do. If passed, this measure would allow state government to retain and spend all revenues it collects in a given year.

Context and History

The 1992 TABOR Amendment to the state constitution is best known for its requirement that all tax increases be approved by voters at the state or local level. But it also contains a long set of other provisions that seek to restrain state and local spending.

Proposition CC addresses the TABOR provision that limits annual spending increases by a government entity to the rate of consumer inflation plus population growth. Voters in many local jurisdictions, especially school districts, have overridden their limits on revenue growth.

In 2005, voters approved Referendum C, a five-year time-out in the state spending limit that also made some adjustments to how the spending limit is calculated. Proposition CC would be permanent, like many local government overrides are.

Whatever your philosophy about government spending, it’s important to understand that lifting the limit wouldn’t necessarily create a steady, predictable windfall of new money for the state, and keeping the limit wouldn’t put big bucks back in taxpayers’ pockets

State revenues come in under the voter-approved limit in more years than they exceed it—and not every taxpayer will receive a refund following years when there’s a surplus. The first $160 million of refunds are used to reduce senior citizen property taxes.

How It Would Work

If Proposition CC passes, legislative staff economists estimate an additional $310 million would be available for spending in the 2020-21 budget year, with $342 million available in 2021-22, which is as far in the future as the estimates go. Some estimates predict larger surplus revenues in 2020-21, but economists note any surpluses would evaporate quickly after the next recession hits.

Accompanying legislation reserves the money in equal slices for public education, state colleges and universities, and transportation. So each area would receive $103 million in 2020-21 and $114 million in the following budget year, if those projections turn out to be accurate.

These are small numbers in the context of overall state spending, which is more than $32 billion from all sources in the current budget year.

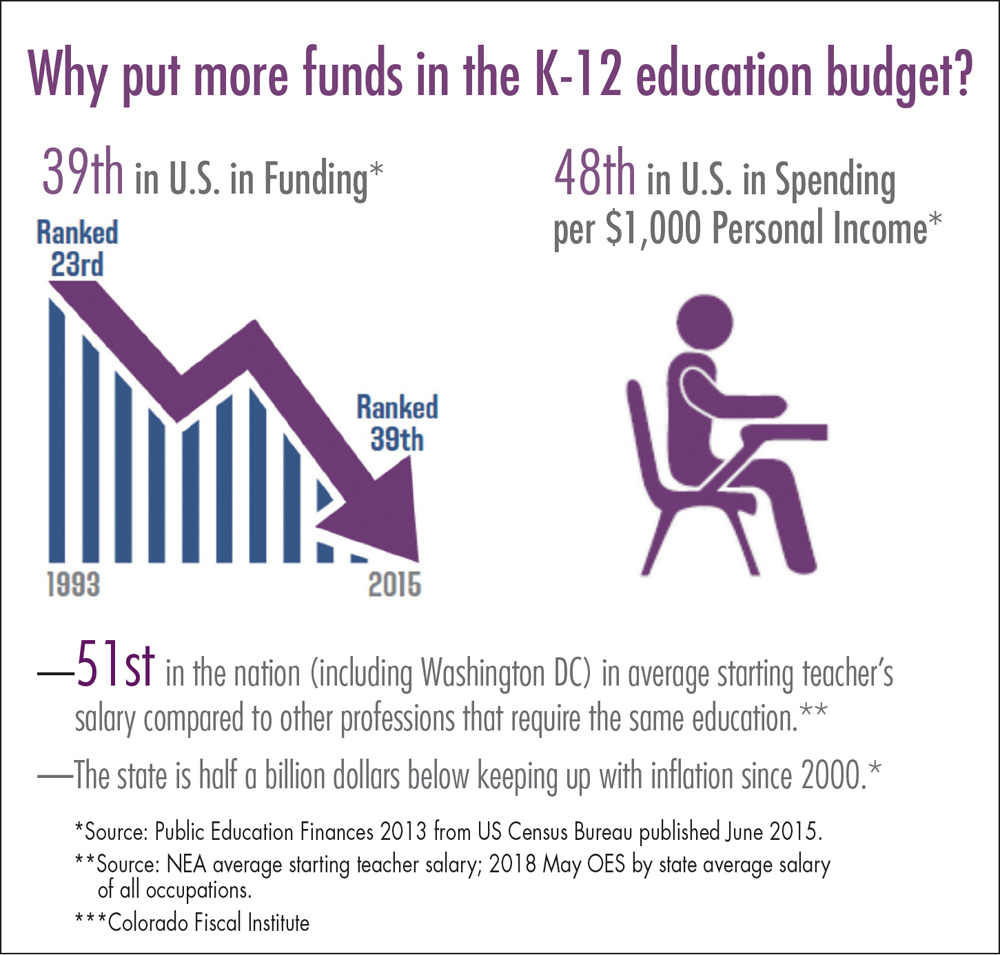

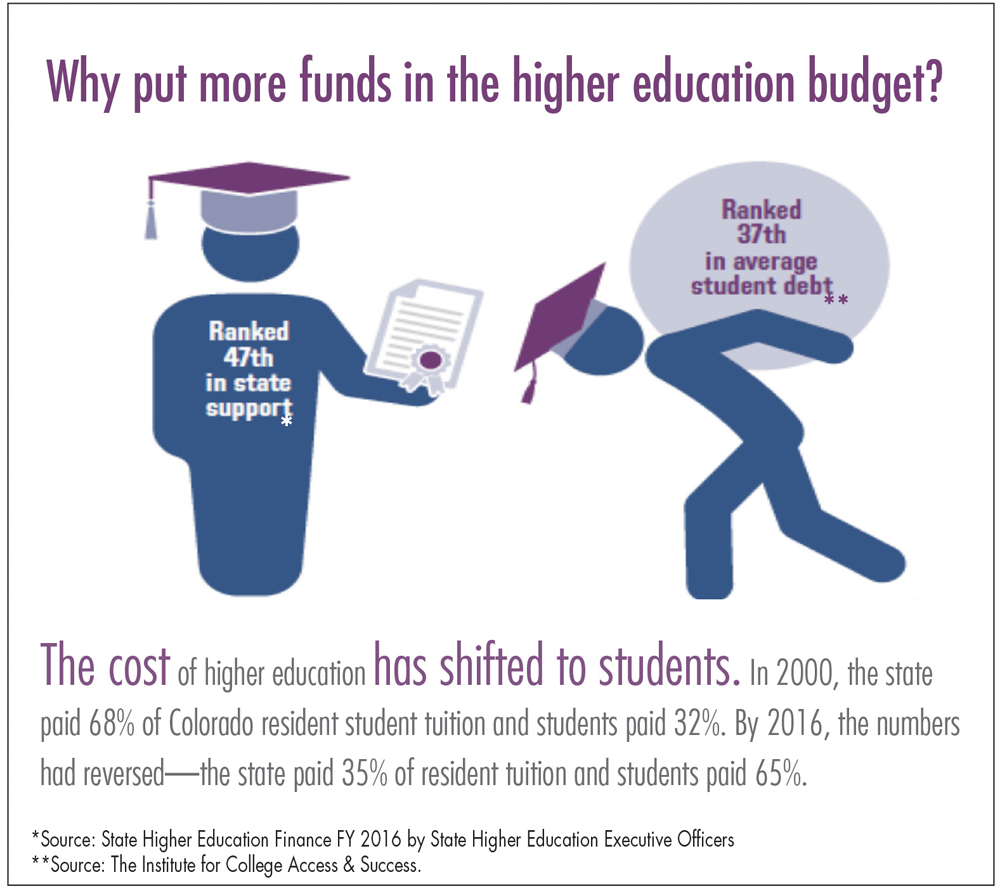

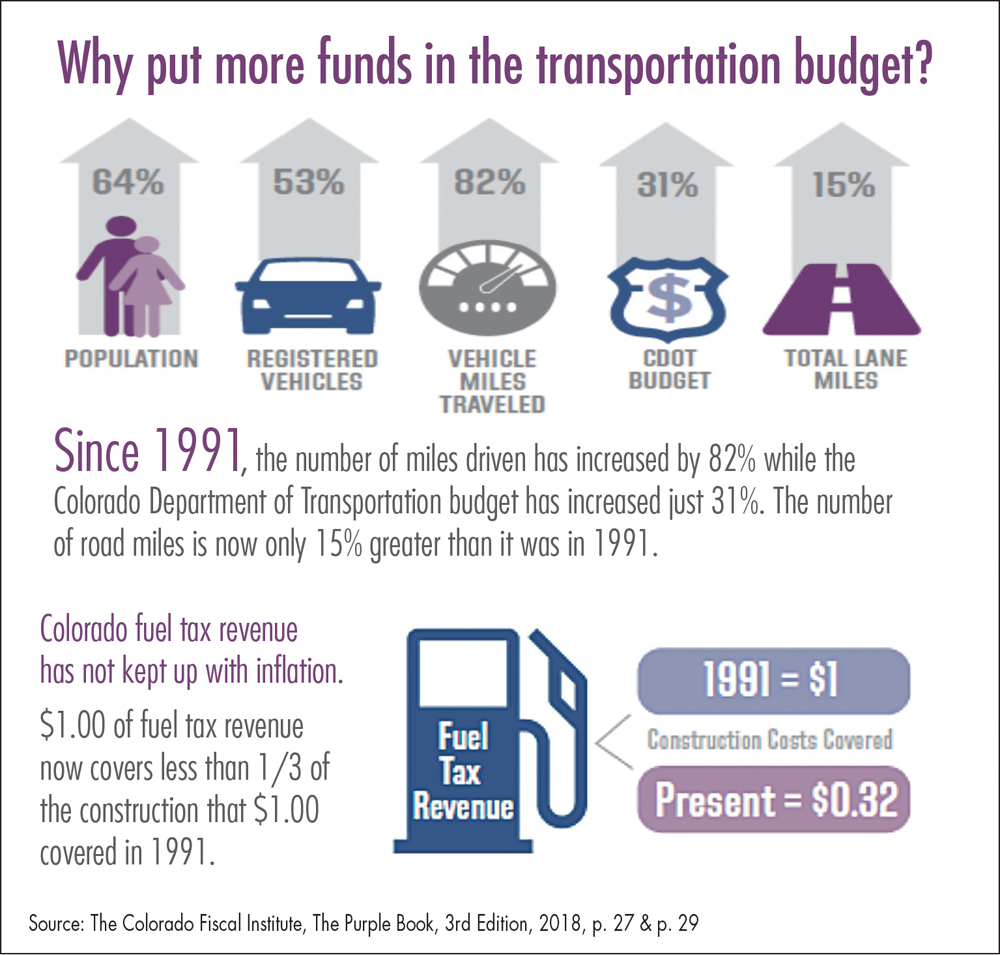

Current basic K-12 spending is more than $7.4 billion, the total for higher education is above $4.8 billion, and transportation funding is some $2.1 billion. (These totals include more than state income and sales tax revenues that are controlled by TABOR. Schools receive about a third of their funding from local property taxes, a majority of higher education revenue is generated by student tuition, and transportation is supported by gasoline taxes and federal funds.)

Who’s Behind It

The 2018 elections gave Democrats control of both legislative chambers and the governor’s office. That made it possible to pass the bill that put Proposition CC on the ballot. Democratic elected officials pretty much support it unanimously; Republicans oppose it, with a few exceptions.

Lifting the state spending limit—at least in concept—also is supported by several center-liberal advocacy and research groups, including the Colorado Fiscal Institute, the Bell Policy Center, Great Education Colorado and Building a Better Colorado.

Who Opposes It

Republican orthodoxy in Colorado generally means opposing any attempts to tinker with TABOR or increases in state spending. A conservative group named Colorado Rising Action, whose director previously worked for the Koch-connected Americans for Prosperity, is campaigning against CC. But as of mid-September there was no overt campaign activity either for or against the measure.

Carol Hedges, Executive Director of the Colorado Fiscal Institute (left) and State Senator Lois Court explain Prop CC at a community meeting in Park Hill. Hedges pointed out that Colorado has the 45th lowest taxes in the country, and due to TABOR, income taxes will be further lowered to 4.5% for 2019.

A pro-CC committee, Coloradans for Prosperity, was registered with the Department of State and reported contributions of $200,000, raised by four equal donations from a teachers-union related group, a construction industry committee, liberal donor Pat Stryker, and former University of Denver chancellor Dan Ritchie. A committee connected to Great Education Colorado reported raising about $51,000 in support of the proposal.

A committee connected to Americans for Prosperity has reported spending nearly $300,000 of in-kind contributions against the measure. And a committee named No on CC reported raising about $14,000.

Pros and cons

Opinions about this measure are mostly driven by whether one thinks state government has too little revenue or already spends too much. Beyond that, there’s not a lot of policy nuance to argue over.

Supporters agree that state revenue has grown since TABOR was passed in 1992. But they note that the subsequent events and trends have created budget needs not anticipated so long ago. Those include the mandatory K-12 increases required by 2000’s Amendment 23, the ratchet down of local school district revenues caused by other constitutional amendments, steeply rising Medicaid costs, and stagnant transportation revenues.

Opponents generally argue that state government has plenty of money and that lawmakers just need to adjust priorities.

Links to texts and advocate information

Full text of measure:

Search for “Amendments and Propositions on the 2019 Ballot” at sos.state.co.us

Additional information:

At Ballotpedia.org, search for Colorado Proposition CC

Yes on CC: https://yesonpropcc.com/

Vote No on CC: http://votenocc.com

Graphics courtesy of the Colorado Fiscal Institute, The Purple Book, 2018 edition

0 Comments