$454.4 million has been spent so far on infrastructure & financing

Of the $454.4 million spent on Stapleton regional infrastructure so far, $332 million came from Tax Increment Financing (TIF). Under TIF, tax revenue generated by improvements at Stapleton is used to finance and build the regional infrastructure for 25 years, from 2000 to 2025.

But TIF comes with an inherent challenge. The later years of the 25-year TIF plan generate the most TIF revenue—but funds are needed in the earlier years to build the infrastructure that generates the revenue. The faster development moves forward, the more revenue will be generated under TIF—and with that revenue more projects can be completed. The challenge is how to leverage future revenue to get current financing to forward as rapidly as possible.

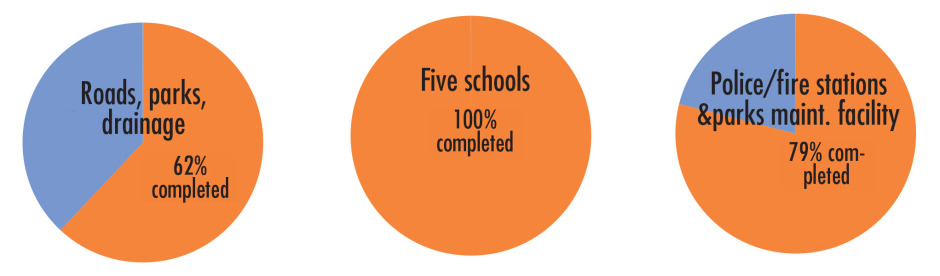

Although the schools and most of the city facilities are completed, 38% of the roads, parks and drainage work still remains.

The remaining regional infrastructure is projected to cost $130 million (excluding financing costs)—and a funding plan for up to $60 million of that is now in place.

Completed and remaining regional infrastructure

95% of future costs will be for roads, parks and drainage

A low interest loan for up to $60 million

The City of Denver’s Finance Department, in partnership with Denver Urban Redevelopment Authority (DURA), the entity that issues bonds and manages Stapleton financing, has found a way to obtain a low interest rate on a bank loan. The proceeds of this loan will keep development moving as fast as possible and, with low financing costs, more will go directly to projects. The plan is a line of credit type loan for up to $60 million if development continues as projected. The key to the favorable interest rate is that the loan is secured by Stapleton’s “City Retained Taxes (CRT).” CRT refers to the portion of TIF paid to the city for services in Stapleton (see charts on next page).

An independent consultant assessed Stapleton’s TIF revenue history and growth projections. That information was used to evaluate risk at specific levels of debt service.

The city and DURA determined an initial draw of $36 million can be taken. If revenue exceeds forecasts, DURA can borrow $60 million for Stapleton’s regional infrastructure over the next few years. If growth falls short, CRT funds will be used to make loan payments; there will be no additional draws beyond the $36M; and future TIF would be used to repay the city. A City Council committee has unanimously approved the plan and the full council is expected to vote on it in early December.

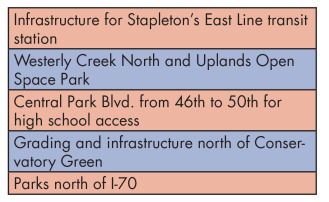

Projects Eligible for the $60 million loan

Forest City, DURA, the City of Denver and the Park Creek Metro District jointly created and agreed on a list of projects eligible to be funded with loan proceeds—all projects were determined to be essential to keeping development moving forward. Most of the currently projected TIF revenue through 2025 will go toward the $60 million loan payments. As additional TIF funds are available, more projects can be completed.

2014-15 projects—projected cost $58.9M*

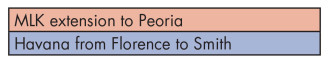

Two additional projects were identified as “eligible” for the loan proceeds if funds from other sources become available for them: MLK extension to Peoria and widening the Central Park Blvd. bridge from 36th to 49th. If that happens, one or more of the projects listed above would likely be delayed and built with funds from another source.

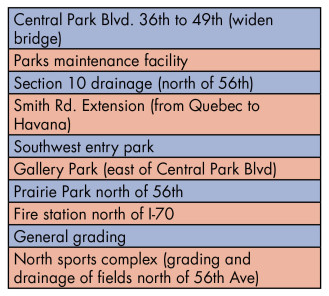

Projects from 2016 to 2019 —Projected cost $54.2M**

TIF revenue for 2016-19 is projected to be $28.5 million (after debt service) and $54.2 million of projects have been identified as priority for construction in this timeframe.

Projects from 2020 to 2025—Projected cost $30.5M**

TIF revenue for 2020-25 is estimated to be $67.3 million (including bond reserves) with estimated construction costs of $30.5 million.

TIF (Regional) vs. local projects

Stapleton infrastructure includes both regional (shown in the pie charts) and local (neighborhood streets, pocket parks, pools). Regional infrastructure is paid for with TIF revenue; local is paid for by the special district tax on Stapleton property. The amount of TIF spent to date is $454.4 million—the amount spent on local infrastructure to date is $275.6 million. A total of $730 million has been spent on infrastructure to date.

Until 2014, all TIF revenue has been used to cover debt service on bonds. In 2014, for the first time, TIF is projected to exceed debt service payments—by approximately $5 million.

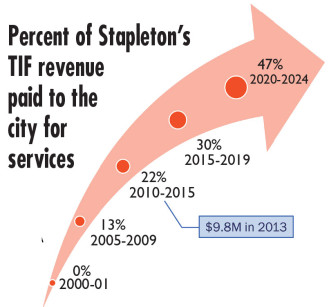

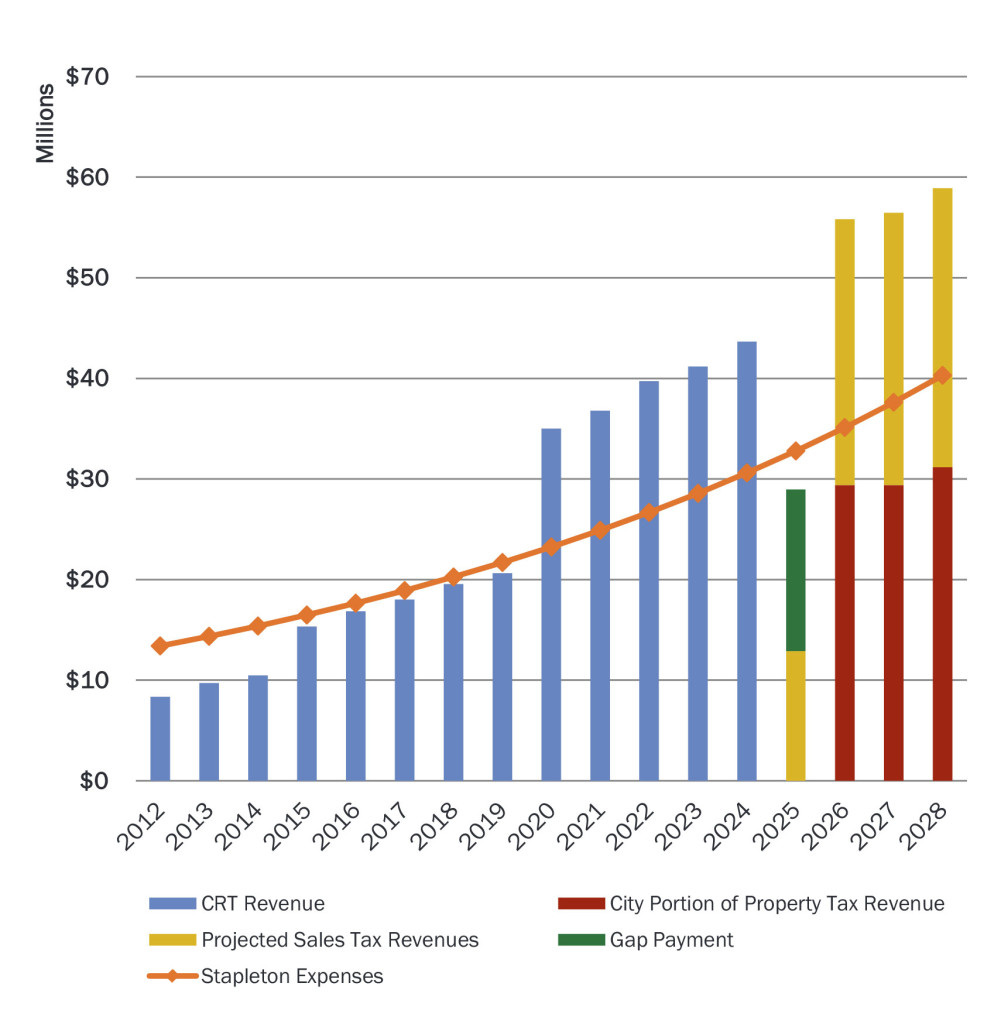

More about City Retained Tax

In the early years of Stapleton development, there were few residents, businesses, or city amenities so city expenditures for police, fire, libraries, rec centers, etc. in Stapleton were low. But as more development occurs, the draw on city services increases, so, over time, a larger percent of the TIF revenue is transferred to the city to cover these costs. This is called the City Retained Tax. The graphic below shows how the CRT increases over the life of the TIF.

The chart below shows how Stapleton’s CRT payments compare with the estimated real cost to provide city services in Stapleton.

How much Stapleton TIF revenue goes to Denver for City Services?

Denver’s CFO Gives Stapleton Overview

Denver’s Chief Financial Officer Cary Kennedy, presented highlights of Denver and Stapleton at the mayor’s “Cabinet in the City” on November 1. She said Denver has the highest credit rating, triple A, by all three credit rating agencies and, in a recent audit that compared Denver to seven other top rated cities, Denver ranks number one.

Denver’s Chief Financial Officer Cary Kennedy, presented highlights of Denver and Stapleton at the mayor’s “Cabinet in the City” on November 1. She said Denver has the highest credit rating, triple A, by all three credit rating agencies and, in a recent audit that compared Denver to seven other top rated cities, Denver ranks number one.

She said Stapleton is the largest infill development in the entire country and it now has 6,000 homes and over 1,000 apartments; there are 19,000 residents (about the population of Golden). A total of $730 million in local and regional infrastructure improvements have been made. Current total property value is $2.8 billion (more than Cherry Creek and more than Washington Park neighborhoods). There is over two million square feet of retail space and almost two million square feet of industrial and office space—with almost 400,000 square feet of office space filled. A total of 917 acres of parks and open space have been developed. And last year there was $520 million in taxable sales in Stapleton.

She explained that these improvements have been made with property and sales tax from Stapleton through Tax Increment Financing and through the Westerly Creek special district assessment (as shown on the projection behind her in the photo at left).

In 2025, Stapleton will have almost $7 billion in property value and will generate over $100 million a year in tax revenue. “Going from zero to $7 billion in 25 years is probably unprecedented in the US,” Kennedy said.

Great article. What does “gap payment” mean in 2025? I didn’t see any explanation in the article, but noticed the strange drop in revenue for the city.

Taxes are collected and put into TIF in the first half of the year. But the City Retained Tax payment for Denver services to Stapleton is made in the second half of the year. In 2025, since the TIF no longer exists after July 1, there will be no City Retained Tax payment. When the city and DURA realized this gap will exist in 2025, they made an agreement for a one-time payment before the TIF ends to partially cover city services provided to Stapleton in 2025.