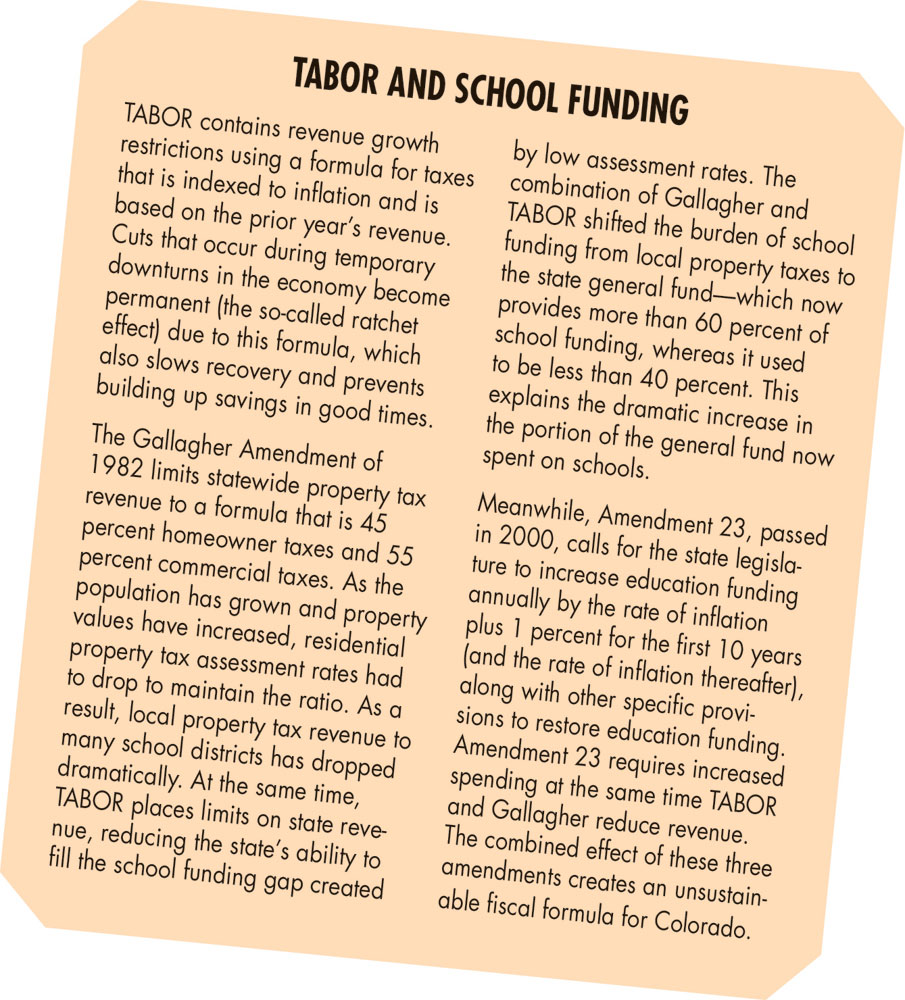

Colorado newcomers still learning the difference between the Front Range and the kitchen range may already have figured out that something called “TABOR” largely determines Colorado politics, tax policy and funding. Colorado is the only state in the nation with a Taxpayer Bill of Rights (TABOR), an amendment to the Colorado Constitution passed in 1992 that mandates revenue caps, among many other requirements related to revenue and taxation. TABOR was a response to taxpayer concerns over growth in government and increased taxation. Twenty-five years later, even long-time Colorado residents still grapple with understanding TABOR and its impacts. Similar laws have been considered in at least 30 states and TABOR proposals reached the ballot in five other states, including Maine, Nebraska and Florida. All were voted down.1 Arizona Gov. Jan Brewer, a conservative Republican, vetoed a TABOR proposal in 2011, explaining, “We should learn from the state of Colorado that experimented with a similar measure, and failed.”2 TABOR has succeeded in its goal of limiting revenue growth and size of government—but parents of school children may be seeing its impacts: Colorado was 41st in the nation for pupil-teacher ratio in 2014-15,3 nonmandatory programs like early childhood education (ECE) have been cut back4; and with teacher wage competitiveness at 49th in the nation,5 Colorado districts are facing teacher shortages. [See orange box on school funding.]

Of course, the impact of TABOR extends beyond schools. Colorado’s general fund revenues are 4.2 percent below 2007-2008 levels (when adjusted for population and inflation). The Bell Policy Center reports that Colorado now ranks 37th among states for highway spending when measured against per capita personal income.

Most Recent Legislative Fix Fails

In late March, a bipartisan proposal (HB1187) to change the TABOR revenue limits failed when it was sent to a Republican-controlled committee, where it died on a 3-2 party-line vote. With voters showing an increased interest in legislators’ positions and votes, even though this bill has died this year, we hope Front Porch readers will find this TABOR explanation useful. TABOR-related legislation is likely to resurface in future years.

TABOR History

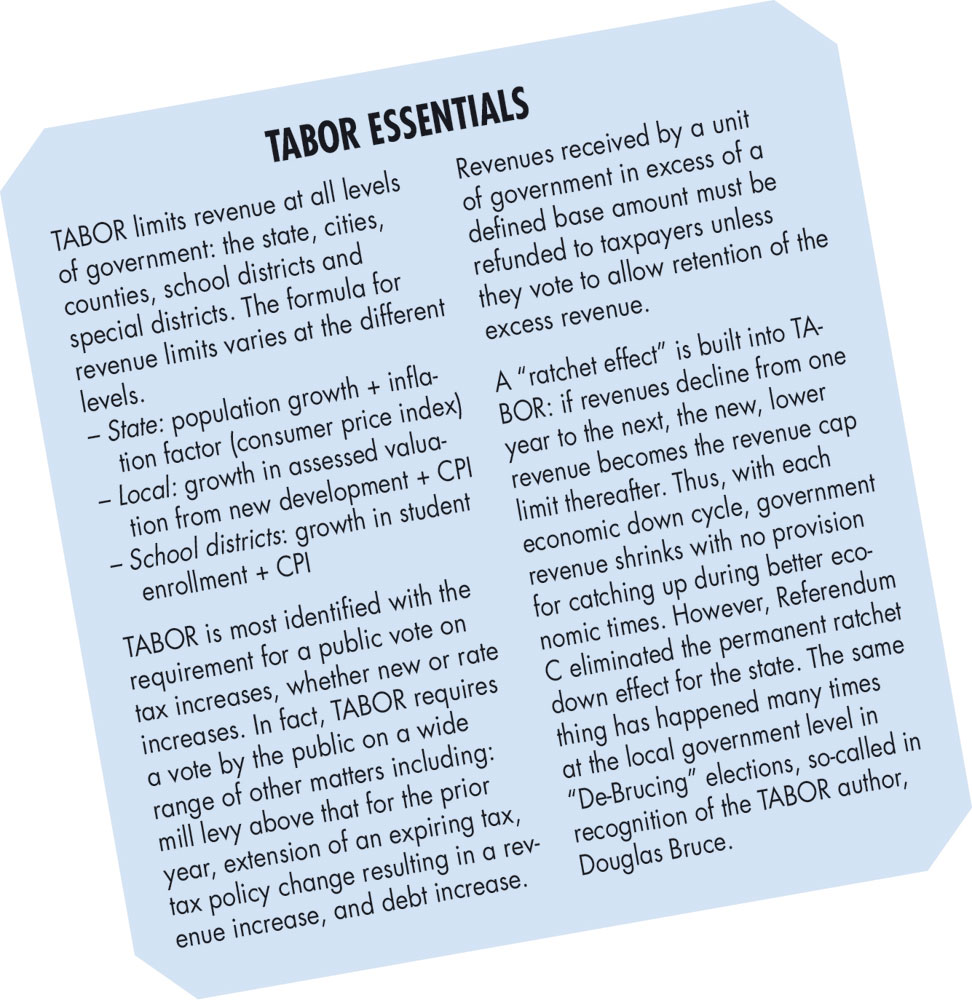

The campaign for TABOR in 1992 focused on a mandate to have citizens vote on tax increases. (It is worth noting that traditionally in Colorado, most units of government voluntarily put such measures to a public vote). TABOR, however, turned out to contain many other requirements that have had wide-ranging implications for the state. Those include revenue caps at all levels of government that are tied to the prior year, votes on many fiscal-related issues, a mandated flat (not progressive) state income tax, and a complete prohibition of certain kinds of taxes. [See blue box on TABOR.]

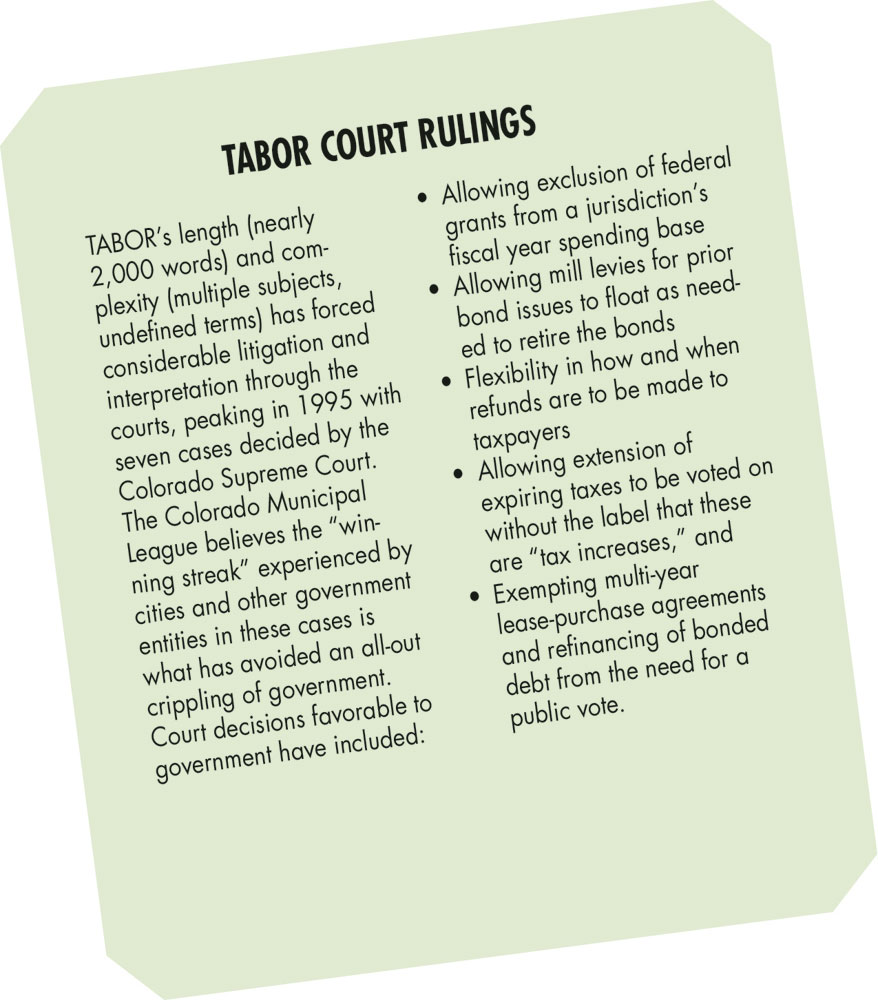

The amendment is so complicated legislators and lawyers have been studying it for years, and the courts have made numerous interpretations and rulings on it. [See green box on court rulings.]

TABOR reflects the voters’ search for a balance between representative and populist, direct-democracy forms of government, says former State Sen. Pat Steadman who served as chair of the Colorado Legislature’s Joint Budget Committee. “Most people really have no desire to get into the weeds of tax policy—and yet they’re the ones who insisted that they be placed in the driver’s seat. It’s a power that most voters were quick to take for themselves but were loathe to exercise for themselves.”

Steadman says the amendment couldn’t make it to the ballot today because after voters approved TABOR and the legislature realized the breadth of its impact, they referred to the voters a measure requiring that initiatives amending the Constitution be limited to a single subject. Voters handily approved that change in election law in 1994. That, combined with the 2016 Amendment 71 requirement for 55 percent of the vote to amend the Constitution, means TABOR will never be changed all at once.

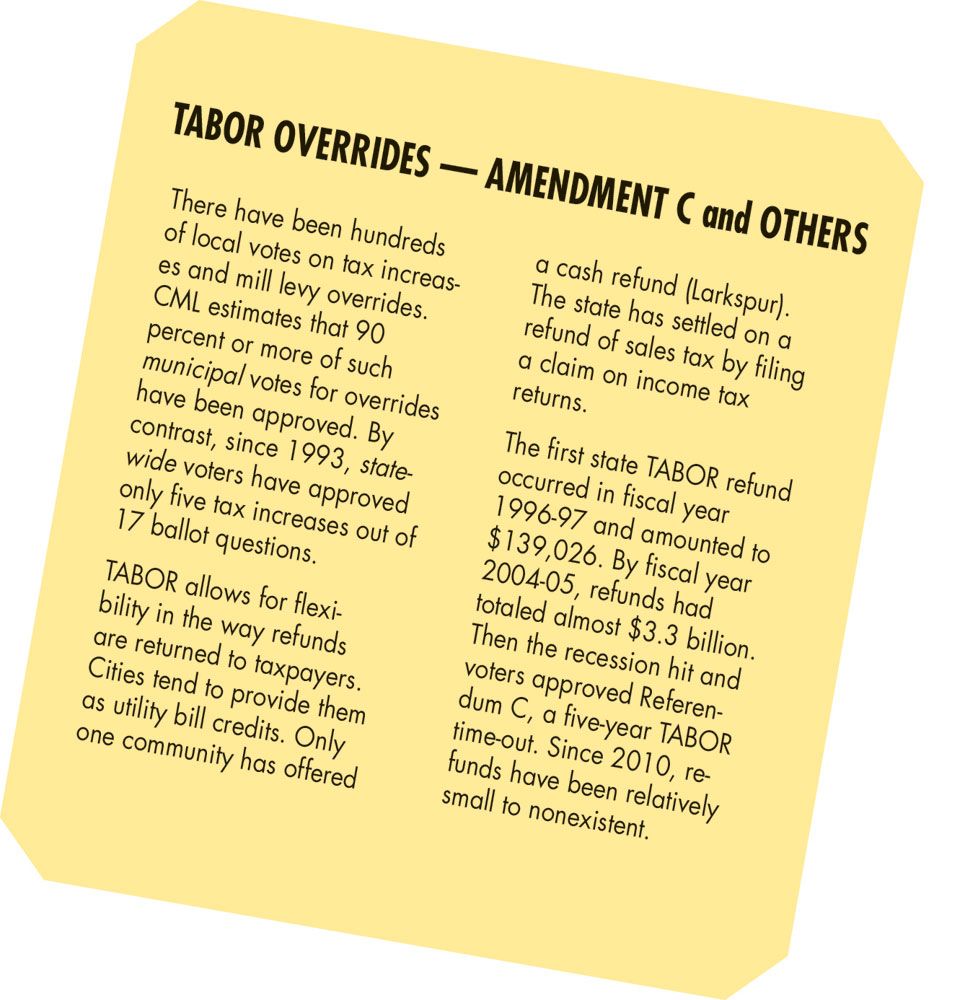

Future changes will have to happen piecemeal through individual, single-subject amendments. In the meantime, the legislature can refer TABOR override measures to the voters as they did in 2005 with Amendment C [see gold box] and might have done this year with HB1187.

Changing the TABOR Revenue Cap Formula?

HB1187 would have changed the current TABOR revenue cap from population growth plus inflation [as explained in blue sidebar] to a rolling five-year average of personal income growth. Proponents believe personal income growth is a better measure of economic activity than the Consumer Price Index (CPI), a measure of inflation that gauges changes in the cost of goods and services that individual consumers buy (e.g., housing, transportation, and food), rather than the services that state government pays for like education and health care. In addition, Colorado has rapidly growing numbers of senior citizens and children, two segments of the population that require the most state services. Another rationale is that a rolling five-year average will smooth out the effect of economic cycles and create more stability in state budgeting.

Estimates were that HB1187’s revision to the state’s revenue cap would have generated an additional $342 million in revenue over the next two years.

Steadman notes that HB1187 would have been only a “tweak to a calculation under TABOR,” leaving the TABOR framework intact. Such proposed changes in tax policy are allowed under TABOR. If approved by the legislature, the item would have been referred to the voters for a decision at the November election. This statewide vote would be similar to votes on tax increases or “mill levy overrides” proposed by Colorado cities and school districts, which are also subject to TABOR.

Sales Tax Increase for Transportation?

The General Assembly is considering at least one other measure (HB1242) that requires a TABOR vote: a sales tax rate increase of 0.62 percent (from 2.9 percent to 3.52 percent) for 20 years beginning in 2018, to generate $677 million annually for highway and transit projects. Passage is uncertain as the parties clash over whether to create an entirely new revenue source (Democrats) or offset the new tax with cuts elsewhere in the state budget (Republicans).

Hospital Provider Fee? Probably Not.

In prior years, re-classification of the hospital provider fee (HPF) was proposed but rejected as a partial solution to the state’s budget constraints. The HPF, created in 2009, is essentially a per hospital bed charge used to fund expansion of eligibility for the state Medicaid program. Democrats have wanted to locate those revenues within a state “enterprise” fund to remove the estimated $700 million from the state’s revenue cap. TABOR allows such government-owned businesses that are primarily funded through fees to be separated from government functions that are paid through general funds. City utility functions (water, wastewater, drainage) or golf operations are typical examples of enterprise funds. Republicans have opposed this reclassification of the HPF in prior sessions and it appears unlikely that the issue will be revisited in the current session of the General Assembly.

Footnotes:

- Center on Budget and Policy Priorities, www.cbpp.org/

- 2. Arizona Capitol Times, “Brewer vetoes bill to limit state spending,” by Caitlin Coakley Beckner, April 28, 2011, http://azcapitoltimes.com/news/2011/04/28/brewer-vetoes-arizona-bill-to-limit-state-spending/

- National Center for Education Statistics, 2014-15: “Selected Statistics From the Public Elementary and Secondary Education Universe: School Year 2014-15”

- From Brian Eschbacher, DPS: “ECE-3 and ECE-4 are not guaranteed since there is very limited state funding and it is not a mandatory program. We have to prioritize classrooms for students attending K-12. This is the case in most neighborhoods across the city.”

- Great Ed National Comparison Chart—compares teachers to non-teachers with similar education, experience and hours worked. “Is School Funding Fair? A National Report Card,” sixth edition (January 17), Education Law Center, Rutgers Graduate School of Education. www.schoolfundingfairness.org

thank you very informative, but where do I access the original tabor law and the recent tabor ammendment in it’s original black and white?

See section 20

https://ballotpedia.org/Article_X,_Colorado_Constitution#Section_20