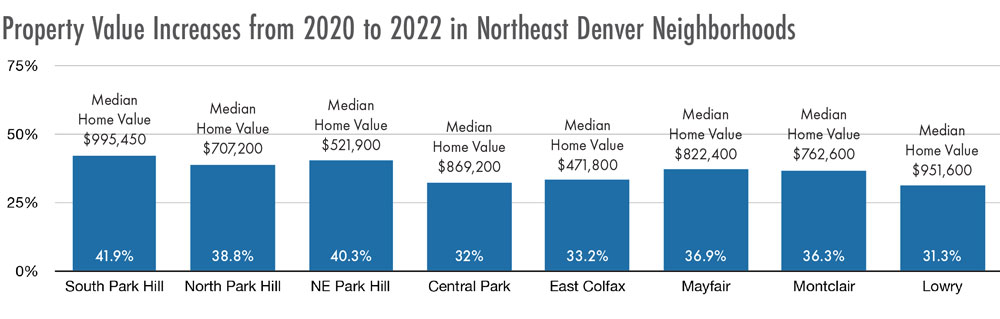

Many homeowners throughout Colorado were alarmed to discover that the home valuations they received in May were disproportionately higher than usual and could burden them with exorbitant property taxes. Denver experienced a median valuation increase of 33 percent, and most Northeast neighborhoods were on the high end of that average.

Many homeowners throughout Colorado were alarmed to discover that the home valuations they received in May were disproportionately higher than usual and could burden them with exorbitant property taxes. Denver experienced a median valuation increase of 33 percent, and most Northeast neighborhoods were on the high end of that average.

“I’ve been doing this for 29 years, and I don’t remember the median increase in Denver ever being to this level,” says Keith Erffmeyer, the Denver County Property Assessor. “It’s the highest increase we’ve ever had, that’s true statewide, and so this increase is very historic.”

Certain factors contributed to the skyrocketing values of homes during this assessment period, including the recovery from the Covid pandemic, the influx of new residents, and the shortage of available housing. However, Erffmeyer believes the reduced number of sellers significantly contributed to the increased values of homes.

Certain factors contributed to the skyrocketing values of homes during this assessment period, including the recovery from the Covid pandemic, the influx of new residents, and the shortage of available housing. However, Erffmeyer believes the reduced number of sellers significantly contributed to the increased values of homes.

“There wasn’t enough of a supply of willing sellers to keep up with the high demand of people wanting to purchase,” explains Erffmeyer. “With the increased demand to live in Denver, buyers had to compete with 10 or 20 other people, so they were willing to pay increasing numbers and we had a phenomenon of properties being sold within 48 hours.”

Many residents are concerned that the jump in their home valuations will also lead to a spike in their property taxes. This has caused a high volume of residents to file petitions to appeal the valuations and argue for reductions. People can file their petitions until June 8, and the assessors will mail out all determinations on Aug. 15.

Denver usually approves approximately 50 percent of appeals, and certain strategies can improve the efficacy of the petitions and the chances of getting approved. “I refer to the Three C’s,” explains Erffmeyer. “One is to review the characteristics and make sure that’s right. Then there are the comparable sales from the appropriate period, and third is the condition of the property and whether it’s typical for the neighborhood.”

The repeal of the Gallagher Amendment is also impacting the dynamics of the property taxes. Gallagher required residential and commercial property taxes to provide the State with similar revenue levels. When the housing market soared, Gallagher held down residential tax rates to match commercial rates. It meant that Colorado residential property taxes were some of the lowest in the nation. However, insufficient tax revenue hindered cities from providing public services for residents and prevented schools from having adequate funding for students. Since Colorado voted to repeal Gallagher by an overwhelming margin in 2020, now there is no mechanism to pull down the property tax increases.

CO State Senator Chris Hansen who co-sponsored Senate Bill 303

For this reason, the State Legislature passed Senate Bill 303 in the last days of the session to provide tax relief for Colorado residents. SB 303 will appear on the November ballot as Proposition HH, and the bill was championed by Governor Jared Polis and co-sponsored by State Senator Chris Hansen, who represents Northeast Denver residents. The bill decreases the property tax rates from 7.1 percent to 6.7 percent, and it also allows homeowners to reduce their home valuations by $50,000.

“We wanted a package that would provide significant tax relief without causing giant fiscal problems, and for the average homeowners this will wipe out about 60 percent of their increases,” says Sen. Hansen, who also contends that the valuation reduction primarily benefits vulnerable residents and struggling families. “That $50,000 will disproportionately help lower income homeowners. That number’s not a big deal if you own a $2 million home, but it’s a really big deal if you own a $500,000 home.”

A change to the Referendum C (Ref C) cap is another important component of the bill that would provide extra funding to local governments and school districts. The Ref C cap is a limit on how much revenue the State can retain and spend, and any revenue that exceeds the limit gets refunded to the taxpayers. However, SB 303 would raise that Ref C cap by one percent for ten years and allow the State to allocate the money to cities and districts. “We’re asking for permission to retain that additional revenue to provide backfill funding for the school districts, local districts, water districts, fire districts, and library districts that rely on property taxes.”

House Bill 1311 is also a key feature of the tax relief package. HB 1311 equalizes TABOR refunds by assuring that all taxpayers receive an identical refund of $661 regardless of the income they earned or the taxes they paid. “HB 1311 provides tax relief and refunds to the families who need it most,” says Hansen. “We have a relatively regressive tax system in Colorado, sales taxes hit working families much harder than wealthier families, and so the bill helps make the tax code more progressive and get relief to the folks who are feeling the biggest effects from inflation.”

This property relief package will be placed on the ballot in November, so Colorado voters will decide whether the tax relief package gets implemented.

0 Comments