Far left: Eileen Moore and John Ogle show photos of their recent 5-week trip to Patagonia to their friends, Diane and Wayne DuBois, who are approaching retirement.

The idea of retirement was abstract to John Ogle. He knew he’d retire from his job as director of pediatrics at Denver Health someday but wasn’t sure when. When he saw how much his wife was enjoying her retirement, Ogle was motivated to turn that abstract into a reality. For some, the idea of retirement is a “someday” thing, years away. For others, it’s looming and they are wondering how to make the next phase of their life a success.

What now?

Sandra Thebaud, a Stapleton resident and psychologist who focuses on stress management, says people soon to retire may be thinking: “Okay, once I retire, what time am I waking up? How am I going to fill those hours normally filled with working?” That’s what Ogle’s wife and Kaiser Permanente pediatrician, Eileen Moore, prevented by scheduling several trips soon after her retirement. “I’d heard about others who retired and didn’t have any plans, even for that first day, and immediately wanted to go back to work.”

Even after creating structure and routine, some still struggle, which is when Thebaud recommends examining subconscious, societal beliefs. “Some people may think old people are useless or no longer contributing members of society because they’re not working,” she says. “Those subconscious beliefs affect how you feel about retirement, even though you were consciously looking forward to it.”

Wayne Olsen backpacking the desert/canyon country in Utah. He believes money isn’t necessary for a happy retirement. He enjoys a frugal lifestyle and inexpensive travels.

Park Hill resident Wayne DuBois, who will retire as a physician’s assistant at Kaiser this June, wants to make sure he remains useful. The stimulation of his work, despite tiring 11–12-hour days, has kept him focused. “I have to think about charting my own path when I don’t have a job to direct what I do each day,” he says. “I want to still be useful in some fashion.”

Robert Searns, self-employed as a planner/developer at Green Infrastructure, who at 68 hasn’t retired, sees it as an era of liberation when the pressures to build a career are less relevant. “Simply put, there’s less at stake,” he says. Like DuBois, Searns is concerned about maintaining a purpose-driven life. At some point, he feels it will be nice to have no professional obligations. But for now, he finds it more rewarding to continue being a paid, working professional.

Remember What You Love

“After so many years working, you tend to forget what you enjoy doing because your days are so filled with responsibilities,” says Thebaud. “Between working, raising a family … and just leading a regular life, one runs out of time,” says Wayne Olsen, who retired in his late 50s as a park manager with Colorado State Parks. Olsen now has time to pursue his interests, which include music, working around the house, helping friends and volunteering.

Searns agrees. “I believe one is in a much better position to take risks (in retirement)—I don’t necessarily mean financial or bodily risks, but risks to the ego by being ‘out there’” with bold ideas or playing music semi-professionally, something he’s started doing.

Thebaud also recommends retirees volunteer or mentor to help give meaning to their lives. Moore wanted to volunteer in Haiti and on a Navajo Indian reservation while her medical skills were still up to date. DuBois wants to volunteer maintaining and hiking the Colorado Trail and providing medical assistance to the homeless. “The opportunities will present themselves and if I’m alert, I’ll recognize them.”

Too much togetherness?

Too much togetherness?

Two retirees under the same roof can turn a marriage topsy-turvy. Thebaud says if a couple is prepared for it, retirement can bring them closer but if they aren’t, it can tear them apart. Married 38 years, DuBois and his wife, Diane, who is semi-retired, have talked at length about what it will be like. “She has her interests, I have mine and we have some mutual interests,” says DuBois. “We’ll just see how much that meshes.”

Throughout their 37-year marriage, Ogle and Moore have nurtured their shared and separate interests and so far, retirement hasn’t been any different. A five-week trip to Patagonia tested their ability to get along. “I don’t think I got on her nerves too much,” laughs Ogle. “It was exciting each day wondering what are we going to do, how it would turn out,” says Moore.

Thebaud suggests couples attend a few counselling sessions to prepare for retirement. “There may not be anything wrong in the relationship, but it’s about adjusting to having that much time together.” She suggests couples have date nights as if they’re meeting for the first time. “Because they are kind of just meeting each other again. They’ll discover new things about each other if they give it a chance,” Thebaud says.

It Comes Down to Money

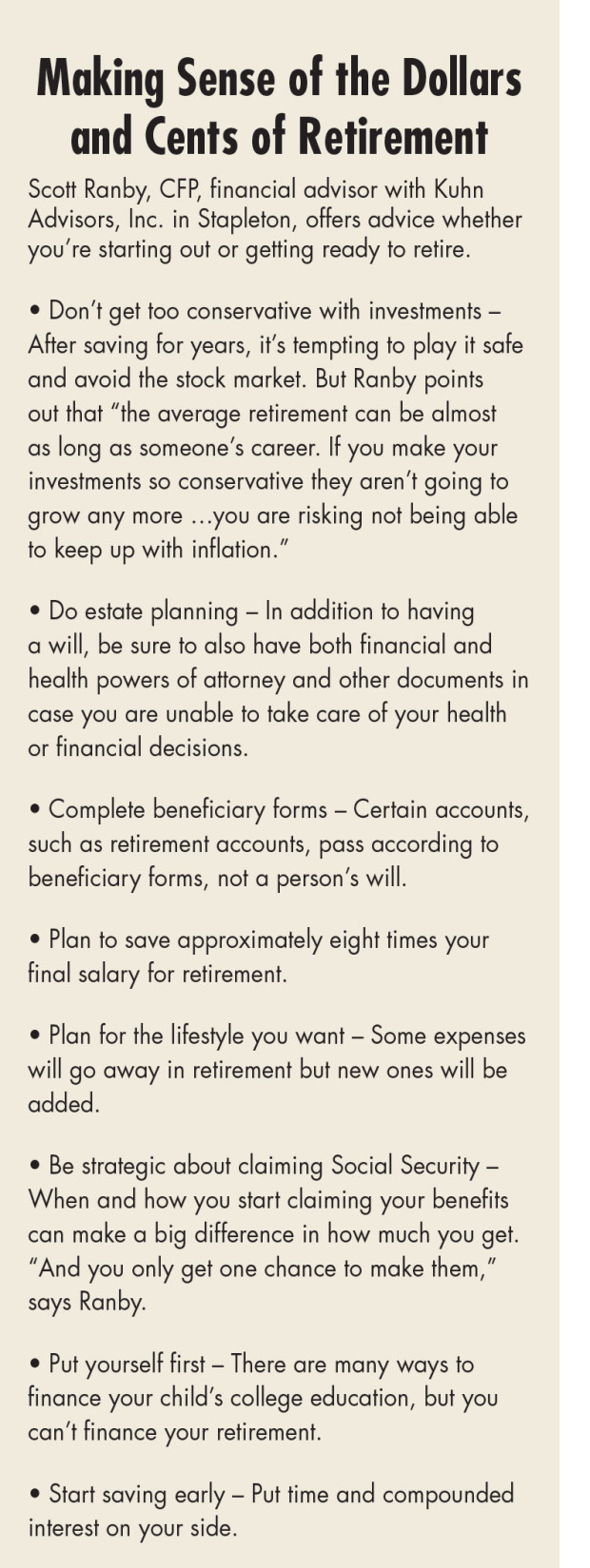

No discussion about retirement would be complete without talking finances. “Everybody’s wondering ‘do I have enough money to last a long life?’” says DuBois. Financial advisor Scott Ranby says there’s reason to be concerned because people can live 25–30 years after retiring.*

When Olsen had the opportunity to retire in his late 50s, he was grateful. He’d had a great career but says he “felt like I had been doing the same dance for a long time.” Olsen isn’t concerned about having enough money to last the rest of his life. He started saving right out of college, investing a little every month in mutual funds and IRAs, taking advantage of company matches. Olsen also lives modestly, cutting back on eating out and doing most of his own home and auto repairs. He has worked some part-time jobs since retiring and knows he’ll probably do so again.

While having enough money is a concern for many in retirement, so is making sure they have enough quality time to enjoy what’s left of their lives. The sudden death of a friend who had been very active was a consideration in Ogle and Moore’s retirement timing. Although they are healthy and very active now, Ogle says they are both aware that, at some point, health issues will change things. Not knowing how much time they will have together, Moore says they figured, “We’d at least feel like we had these years together when we weren’t preoccupied with work. We had time for each other and our interests.”

0 Comments